Purchasing a first car is an exciting milestone, whether for commuting, university or weekend travel. For many buyers, it raises questions about cost, reliability and what models best suit their lifestyle. Approaching the process with preparation can make the experience straightforward and rewarding. Understanding budgets, financing, vehicle types and ownership responsibilities ensures buyers make confident, informed decisions.

Understanding your budget and long-term costs

A successful car purchase begins with establishing a realistic budget. It is easy to focus solely on the sticker price, but ownership also includes long-term costs such as insurance, fuel, regular maintenance and occasional repairs. Setting a monthly spending limit can help first-time buyers evaluate options more effectively.

Many buyers consider purchasing a used vehicle because it often comes at a lower price point and can provide exceptional value. A used car may also reduce insurance premiums, as insurers typically view them as less risky. On the other hand, new cars may include warranties, improved technology and higher fuel efficiency. Understanding how these differences align with financial expectations allows buyers to narrow their choices responsibly.

Choosing the right type of vehicle for your needs

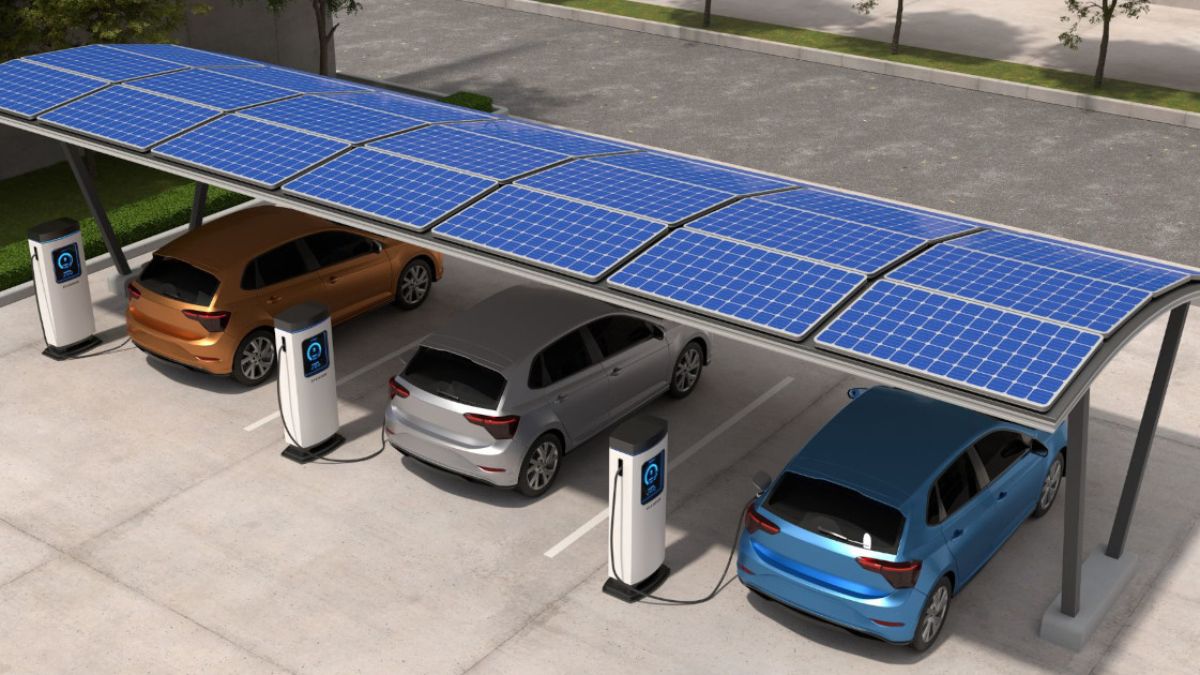

Different lifestyles require different vehicles. Compact cars are ideal for city drivers who value easy parking and fuel efficiency. Larger vehicles such as SUVs may appeal to families or those planning road trips and outdoor activities. Electric and hybrid cars are increasingly popular among environmentally conscious buyers and commuters who want to reduce fuel costs.

When considering vehicle types, first-time buyers should also think about daily habits. A shorter commute may prioritise comfort over fuel range, whereas long-distance drivers benefit from efficiency and reliability. Researching safety ratings, boot space, seating capacity and resale value helps ensure the chosen car supports both present and future needs.

Exploring financing and payment options

Financing plays a major role in first-time purchases. Buyers can choose between bank loans, dealership financing or purchasing outright. Understanding interest rates and loan terms is essential, as these determine the total cost over time. Shorter loan periods generally reduce interest, while longer terms may offer lower monthly payments.

Some buyers take advantage of certified pre-owned (CPO) programmes, which provide a used vehicle inspected and backed by a manufacturer or dealer warranty. These programmes often bridge the gap between affordability and peace of mind, offering additional support for maintenance and servicing.

For those who wish to minimise financial commitments, leasing can be an option. Leasing often results in lower monthly payments and access to newer models, though mileage limits and return conditions are important to consider.

Inspecting and testing before you buy

A thorough vehicle inspection is crucial. Buyers should pay attention to exterior condition, tyre quality, mileage and service history. Even if a car appears clean, reviewing maintenance records ensures it has been cared for properly. This includes oil changes, brake checks and any repairs.

Taking a test drive provides valuable insight into comfort and performance. Listening for unusual noises, checking acceleration and braking, and observing how the vehicle handles at different speeds all help determine whether it meets expectations. A professional mechanic inspection can offer additional reassurance, especially when purchasing from a private seller.

Preparing for ownership with confidence

Once the right car is selected, buyers should review insurance options and compare quotes. Factors such as location, age, model and driving experience influence coverage costs. Some insurers provide discounts for safe driving programmes or defensive driving courses, which can be beneficial for first-time owners.

Buying a first car is a meaningful step toward independence, mobility and personal growth. With a balanced approach—considering budget, vehicle type, financing and proper inspection—new buyers can enter the market confidently. Careful preparation ensures a reliable vehicle that supports everyday life, making the journey into car ownership smooth and enjoyable.