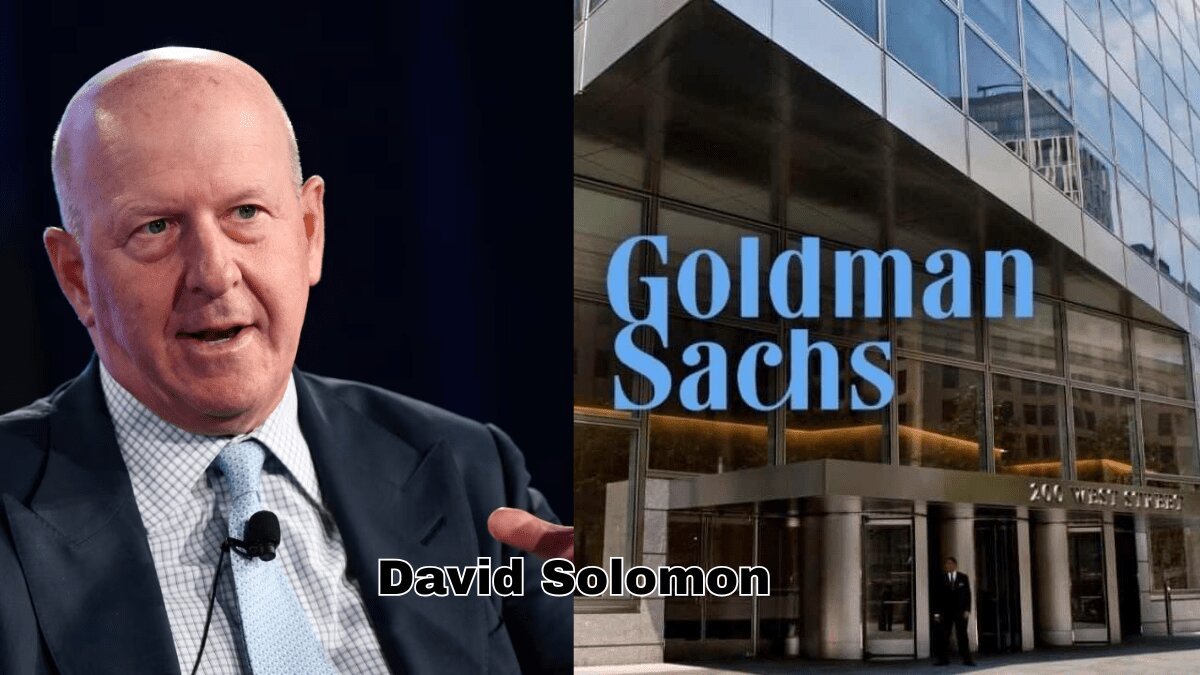

David Solomon – The Banker Who Rewrote Wall Street’s Playbook

In the world of high finance, few names resonate as strongly today as David Solomon, the dynamic Chairman and CEO of Goldman Sachs. Known for blending boardroom brilliance with an unconventional side gig as DJ D-Sol, Solomon has shattered stereotypes of what it means to lead a global financial powerhouse. His biography is not just the story of a Wall Street executive, but of a multi-dimensional figure navigating the intersection of finance, innovation, and culture.

“I think people are always surprised that someone in my position is doing this,” Solomon said, referring to his music career.

(—CNBC Interview, 2019)

Born in 1962 in Hartsdale, New York, and educated at Hamilton College, Solomon took a traditional path into finance but added his own unconventional flair. Rising through the ranks at Bear Stearns and then Goldman Sachs, he eventually succeeded Lloyd Blankfein as CEO in 2018. Yet his journey has been far from traditional. Under his leadership, Goldman Sachs has pivoted from its investment banking roots into more consumer-facing ventures, such as Marcus and Apple Card, redefining the bank’s strategic future.

“We are changing the face of Goldman Sachs,” Solomon stated at an investor conference.

(—Reuters, 2020)

His biography isn’t just one of boardrooms and balance sheets. Solomon has also emerged as a symbol of modern leadership—embracing transparency, adaptability, and even creativity in an industry long associated with rigid tradition. His love for electronic dance music and performances at global music festivals have humanized him in a way few CEOs ever experience.

“I always tell young people to be multidimensional. It makes you better at whatever you do,” he once shared.

(—David Solomon, Harvard Business Review, 2021)

As Wall Street continues to evolve in the face of digital disruption, ESG pressures, and geopolitical shifts, Solomon stands at the helm of one of its oldest institutions, rewriting the rules with confidence and charisma.

Early Life and Education: From Chicago to Wall Street

David Michael Solomon was born in 1962 and raised in Scarsdale, a suburb of New York City—not Chicago, as commonly mistaken. The son of a small business owner and a school superintendent, Solomon grew up in a middle-class family that valued education, discipline, and work ethic. His upbringing played a critical role in shaping his grounded yet driven personality.

“My parents taught me that success wasn’t just about money—it was about working hard and treating people with respect,” Solomon said in a 2020 Forbes interview.

Solomon attended Scarsdale High School, where he was a strong student with a particular interest in economics and public speaking. He went on to study Political Science at Hamilton College, a liberal arts school in upstate New York. While many of his peers targeted Ivy League institutions, Solomon embraced the broad, interdisciplinary education that Hamilton offered.

“The critical thinking and communication skills I developed at Hamilton have stayed with me throughout my career,” he told Hamilton Alumni Review.

At Hamilton, Solomon wasn’t just an academic. He was an active campus leader, involved in various student activities and fraternity life. He even worked part-time selling stereo equipment, revealing early signs of his entrepreneurial streak and salesmanship—two traits that would later define his career on Wall Street.

After graduation in 1984, Solomon entered the finance industry through a sales position at Irving Trust, a New York-based bank. His big break came when he joined Drexel Burnham Lambert, where he was introduced to the fast-paced world of high-yield bonds. That foundational experience set the stage for his entry into Bear Stearns, and eventually Goldman Sachs, in 1999.

“I didn’t come into this business with connections. I had to hustle every step of the way,” Solomon has said.

(—Wall Street Journal, 2018)

Solomon’s early years reflect a unique blend of traditional values and modern ambition. His path wasn’t linear or silver-spooned—it was carved through perseverance, curiosity, and a willingness to adapt. These qualities would later become the backbone of his leadership philosophy at one of the world’s most powerful financial institutions.

Career Milestones: Building Goldman Sachs into a Financial Powerhouse

David Solomon’s rise through Goldman Sachs is a masterclass in strategic thinking, operational discipline, and leadership under pressure. He joined the firm in 1999 as a partner in the Investment Banking Division, after a successful stint at Bear Stearns. Quickly recognized for his sharp analytical skills and ability to close deals, Solomon made partner in record time.

By 2006, he was leading Goldman’s Investment Banking Division, where he played a key role in advising some of the firm’s biggest clients across mergers, acquisitions, and IPOs. His focus on long-term relationships over short-term wins helped Goldman retain its elite status through a period of intense competition.

“We’re not in the business of quick wins. We’re in the business of long-term trust,” Solomon once stated at a corporate summit.

(—Business Insider, 2012)

In 2016, Solomon was named President and COO, alongside Harvey Schwartz, as part of the succession plan for then-CEO Lloyd Blankfein. Two years later, Solomon was appointed as CEO, officially taking the reins in October 2018.

Under his leadership, Goldman Sachs underwent one of the most ambitious strategic overhauls in its history. Solomon focused on diversifying the firm’s revenue, launching consumer-focused platforms like Marcus (a digital bank) and Apple Card in partnership with Apple.

“We need to meet customers where they are—and increasingly, that’s online,” Solomon said during Goldman Sachs’ 2019 Investor Day.

(—CNBC, 2019)

He also prioritized technological innovation, expanding the firm’s capabilities in cloud computing, AI, and risk analytics, while modernizing its back-end infrastructure.

One of Solomon’s boldest moves was increasing transparency around Goldman’s business model—historically shrouded in secrecy. He encouraged open dialogue, public disclosures, and stronger commitments to ESG (Environmental, Social, Governance) principles.

“In today’s world, opacity is a liability. Stakeholders want to know what we stand for,” Solomon noted.

(—Fortune, 2020)

Despite facing criticism for Goldman’s involvement in controversial deals, Solomon has stayed focused on long-term transformation. Under his tenure, the firm has become more agile, tech-savvy, and customer-centric.

“I’m not here to preserve tradition. I’m here to evolve it,” he said in a keynote at the 2021 World Economic Forum.

Today, Solomon leads a redefined Goldman Sachs—one that is not only synonymous with Wall Street success but also with adaptability and innovation in a changing global economy.

Beyond Banking: David Solomon’s Passion for Music and Its Impact on His Leadership

In an industry known for tailored suits and quiet boardrooms, David Solomon stands out—not just as a banker, but as a DJ. Performing under the stage name DJ D-Sol, he has played at music festivals like Lollapalooza and released tracks on Spotify that have garnered millions of streams. For Solomon, music isn’t a hobby—it’s an expression of balance, creativity, and identity.

“Music helps me think differently. It forces me to listen, adapt, and engage with an audience in real time,” Solomon said in a 2021 Rolling Stone interview.

While some have criticized his side hustle as unorthodox for a Fortune 500 CEO, Solomon argues it enhances his effectiveness as a leader. The discipline of DJing—understanding your audience, managing transitions, and performing under pressure—mirrors many of the demands of corporate leadership.

“It’s not about playing tracks—it’s about understanding tempo, mood, and delivering an experience. That’s leadership, too,” Solomon noted on The David Rubenstein Show.

More importantly, his public embrace of a creative outlet has humanized him in the eyes of Goldman Sachs employees and the broader financial community. It has sparked a broader cultural shift within the firm, making it more inclusive, dynamic, and open to non-traditional expressions of talent.

“Seeing someone like him be authentic—it’s empowering,” said a Goldman Sachs analyst in an internal memo.

(—Goldman Sachs Internal Report, 2022)

Solomon has also used music as a platform for philanthropy, donating performance earnings to charities focused on addiction recovery and education. His actions reflect a growing belief that CEOs should be purpose-driven, not just profit-focused.

His dual identity—as both a banking executive and a creative performer—challenges the rigid archetypes of what leadership looks like in finance.

“It’s okay to be more than one thing,” Solomon often says.

(—LinkedIn Blog, 2023)

By embracing his passions, Solomon sets an example for a new generation of leaders—those who blend emotional intelligence, strategic acumen, and personal authenticity to inspire meaningful change.

David Solomon’s biography is more than a tale of corporate ascent—it’s a story of breaking boundaries in both finance and culture. As CEO of Goldman Sachs and the artist known as DJ D-Sol, he has proven that leadership today requires more than just business savvy—it demands vision, versatility, and authenticity. From transforming a 150-year-old financial institution to inspiring professionals through creativity and philanthropy, Solomon exemplifies the future of executive leadership. As Wall Street evolves, so does its most unconventional leader—boldly blending tradition with transformation, and proving that success can be both profitable and profoundly human.