Shares in former President Donald Trump’s social media venture, Trump Media & Technology Group (TMTG), experienced a dramatic drop of over 12% on Wednesday morning, following Tuesday’s presidential debate. The company’s stock fell to its lowest level since going public, trading at $16.29—more than 70% below its peak closing price of $66.22 on March 27.

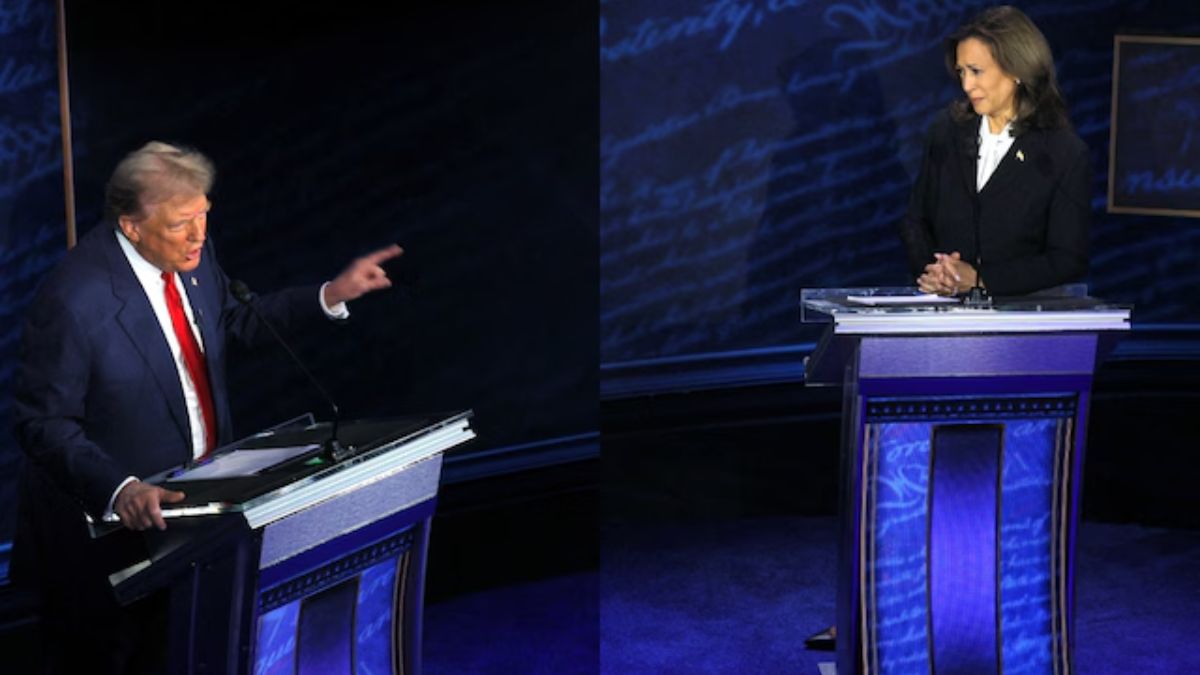

This significant drop comes in the wake of a CNN poll indicating that Vice President Kamala Harris outperformed Trump in the debate. The decline in TMTG’s stock value reflects broader market concerns and investor sentiment tied to Trump’s political and legal challenges.

The success of the stock has been extensively monitored as an indicator of Trump’s political chances. Previous high-profile incidents, such as the former president’s assassination attempt and a debate in July, had caused Trump Media’s stock to soar. Nevertheless, the confidence of investors has sharply reversed as a result of recent events.

Despite the volatility in stock prices, the underlying financial health of TMTG remains a concern. The company reported a loss of over $16 million for the three-month period ending in June, with revenues of only $836,000. These figures highlight the disconnect between the company’s financial reality and its stock market performance, which has been buoyed by dedicated individual investors supporting Trump or believing in the company’s mission.

Next week marks a critical juncture for Trump and TMTG, as the lockup period restricting Trump from selling his shares expires. This could potentially lead to Trump beginning to sell his 115 million shares, valued at nearly $2 billion based on Wednesday’s stock price. Over the past six months, Trump’s stake has depreciated by more than $4 billion.

As Trump faces mounting legal and political hurdles, including his recent conviction on 34 felony counts in New York, the future of his media company and its stock performance remains uncertain. Investors and analysts will be closely watching how these developments impact both Trump’s political prospects and the financial stability of Trump Media & Technology Group.