As individuals plan for their retirement, the Social Security Calculator emerges as a valuable tool, offering insights into the intricate world of retirement benefits. This article delves into the significance of the Social Security Calculator, how it works, and the key factors individuals should consider when utilizing this tool to make informed decisions about their financial future.

- Decoding Social Security: A Pillar of Retirement Planning Social Security stands as a cornerstone of retirement income for many Americans. Understanding the intricate details of this program is essential for individuals seeking to optimize their benefits and make informed decisions about their retirement finances. The Social Security Calculator serves as a vital resource in this endeavor.

- How the Social Security Calculator Works: A User-Friendly Guide The Social Security Calculator is designed to estimate the amount of benefits an individual may receive based on various factors, including their earnings history and the age at which they choose to start receiving benefits. Users input specific details, and the calculator generates projections, providing a clearer picture of potential monthly benefits and the impact of different claiming strategies.

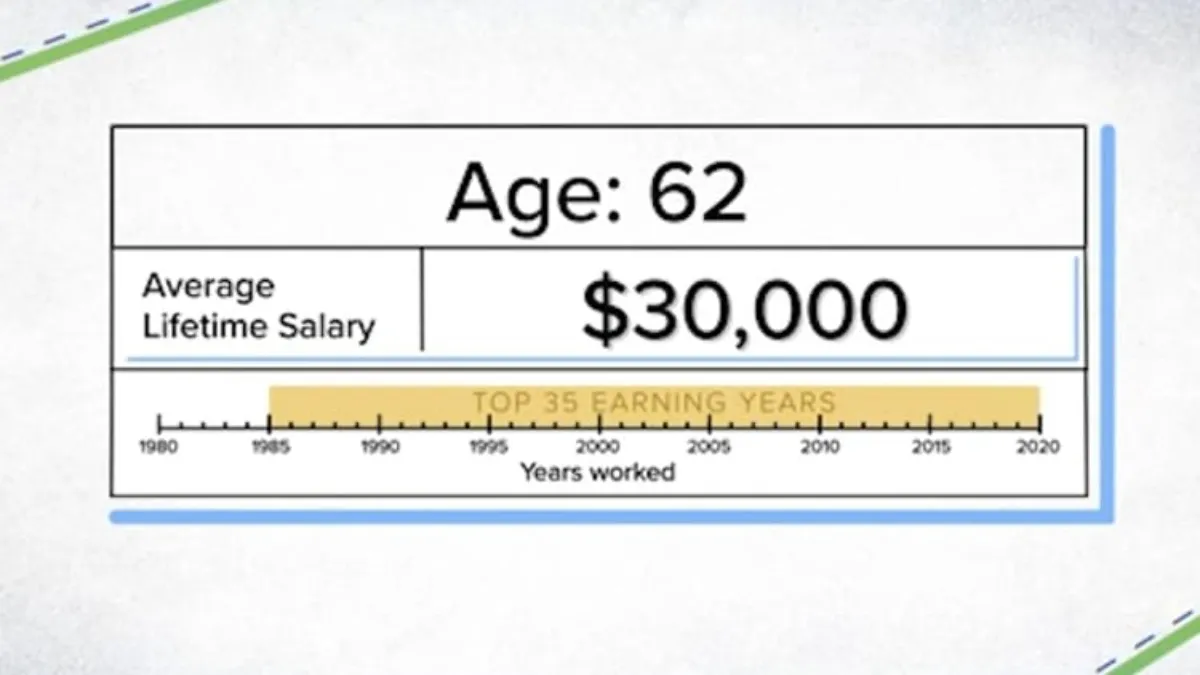

- Factors Influencing Calculations: Earnings, Age, and Claiming Strategy Earnings history plays a pivotal role in Social Security benefit calculations. The calculator considers the highest-earning years, adjusting for inflation, to determine the Primary Insurance Amount (PIA). Additionally, the age at which an individual chooses to claim benefits significantly influences the monthly amount received. Understanding the implications of early, full, or delayed retirement is crucial for maximizing benefits.

- Claiming Strategies: Maximizing Social Security Benefits The Social Security Calculator allows users to explore various claiming strategies to optimize their benefits. Strategies may include waiting until full retirement age, leveraging spousal benefits, or even utilizing delayed retirement credits. Navigating these strategies requires careful consideration of individual circumstances and financial goals.

- Long-Term Financial Planning: Beyond the Calculator While the Social Security Calculator provides valuable insights, it is just one component of a comprehensive retirement plan. Individuals are encouraged to integrate Social Security projections with other retirement income sources, such as pensions, savings, and investments, to create a holistic financial strategy that aligns with their long-term goals.

- Key Considerations and Resources: Making Informed Choices Understanding the nuances of Social Security calculations can be complex. Utilizing resources provided by the Social Security Administration, such as online calculators and informative guides, empowers individuals to make informed choices about when and how to claim benefits. Additionally, consulting with financial advisors can provide personalized insights tailored to individual financial situations.

The Social Security Calculator emerges as a powerful ally in the realm of retirement planning, offering individuals the tools to make informed decisions about their financial future. By understanding how the calculator works, considering key factors, exploring claiming strategies, and integrating Social Security benefits into a broader financial plan, individuals can embark on their retirement journey with confidence and financial security.