An increase in orthopedic problems, an aging population, and an increase in trauma cases are the primary factors driving the growth of the worldwide orthopedic imaging equipment market.

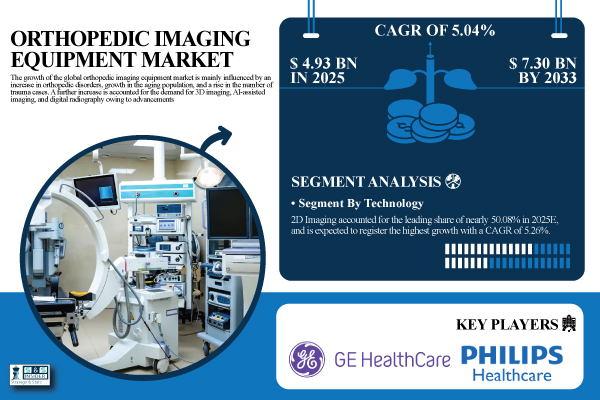

Austin, Dec. 01, 2025 (GLOBE NEWSWIRE) — According to SNS Insider, The Orthopedic Imaging Equipment Market size is estimated at $4.93 billion in 2025 and is expected to reach $7.30 billion by 2033, growing at a CAGR of 5.04% over 2026-2033.

Due to its sophisticated healthcare infrastructure, larger number of hospitals and outpatient imaging centers, a number of private healthcare companies, researchers, and the government’s efforts to develop 3D and AI-assisted imaging technologies, the U.S. holds the largest market share for orthopedic imaging equipment.

The U.S. orthopedic imaging equipment market estimated at $1.48 billion in 2025 and is expected to reach $2.16 billion by 2033, growing at a CAGR of 4.79% over 2026-2033.

Get a Sample Report of Orthopedic Imaging Equipment Market: https://www.snsinsider.com/sample-request/9002

Rising Awareness and Early Diagnosis are Augmenting the Market Expansion Globally

Since patients and physicians rely on diagnostic tests to identify fractures, joint disorders, and musculoskeletal disorders early on, it is projected that growing awareness of the value of early diagnosis will propel the global orthopedic imaging equipment market share. X-ray, CT, MRI, and AI-powered imaging equipment are in high demand since these technologies lead to better therapy when employed in early detection and intervention.

Major Players Analysis Listed in the Orthopedic Imaging Equipment Market Report Are:

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems

- Fujifilm Holdings

- Carestream Health

- Hologic

- Hitachi Medical Systems

- Shimadzu Corporation

- Samsung Medison

- Esaote S.p.A

- Dilon Technologies

- Analogic Corporation

- Orthoscan, Inc.

- Planmed Oy

- Neusoft Medical Systems

- Konica Minolta

- Rayence Co., Ltd.

- Varian Medical Systems

- Other players

Segmentation Analysis:

By Product Type

The X-ray segment accounted for the highest revenue share of approximately 33.87% in 2025E, as it is low-cost, readily available, and vital for diagnosing fractures, joint dislocations, and osseous abnormalities. CT segment is anticipated to achieve the highest CAGR of nearly 5.84% during the 2026-2033 period, driven by its better 3D visualization, ability to accurately identify complex fractures, and its utility in surgical planning.

By Indication

The trauma cases segment held the largest revenue share of approximately 21.53%in 2025E, due to road accidents, workplace injuries, and sports-related fractures on the increase globally. The arthritis segment is predicted to grow at the strongest CAGR of approximately 6.54% during 2026–2033, owing to the increasing prevalence of osteoarthritis and rheumatoid arthritis in elderly people.

By Technology

The 2D Imaging accounted for the largest share of the Orthopedic Imaging Equipment Market with about 50.08%, owing to the online channel for buying insulin, glucose monitors, and diabetic pet diets continuing to grow. The segment is also predicted to grow at the fastest rate with a CAGR of around 5.26% throughout the forecast period of 2026–2033, owing to its low cost, wide availability, and the possibility of being integrated into the clinical routine diagnostics.

By End-User

The hospitals held the largest revenue share of around 42.80% in the Orthopedic Imaging Equipment Market in 2025E, due to their developed infrastructure, large patient volume, and availability of several imaging systems, including X-ray, CT, MRI, and ultrasound, covering different imaging techniques in one place. Diagnostic Imaging Centers segment, however, is projected to register the highest CAGR of around 5.81% during the forecast period of 2026 – 2033, as there is an increasing need for cheap and convenient imaging services.

Need Any Customization Research on Orthopedic Imaging Equipment Market, Enquire Now: https://www.snsinsider.com/enquiry/9002

Regional Insights:

Asia Pacific is the fastest-growing region in the orthopedic imaging equipment market with a CAGR of 5.76% in the forecasted period 2026-2033, due to the rapid urbanization, growing healthcare spending, and high prevalence of orthopedic for instance arthritis, osteoporosis, and trauma incidence.

North America accounted for the highest revenue share of approximately 35.76% in 2025E of the Orthopedic Imaging Equipment Market, owing to the presence of mature healthcare infrastructure, high patient awareness, and adoption of advanced imaging technologies, including AI-based MRI and CT machines.

Recent Developments:

- In March 2025, Launched Revolution AI-Enhanced Orthopedic CT, enabling faster 3D bone imaging, reducing radiation by 30%, and improving fracture assessment and pre-surgical planning accuracy.

- In July 2024, introduced Multitom Rax Plus, a 3D extremity imaging system with AI-assisted fracture detection, offering precise orthopedic imaging for trauma care and outpatient clinics.

Orthopedic Imaging Equipment Market Segmentation

By Product Type

- X-ray

- CT

- MRI

- Ultrasound

- Nuclear Imaging

By Indication

- Trauma Cases

- Sport Injuries

- Spinal Injuries

- Arthritis

- Bone Disorders

- Musculoskeletal Cancer

- Muscle Atrophy

- Others

By Technology

- 2D Imaging

- 3D Imaging

- AI-Assisted Imaging

By End User

- Hospitals

- Diagnostic Imaging Centers

- Others

Purchase Single User PDF of Orthopedic Imaging Equipment Market Report: https://www.snsinsider.com/checkout/9002

Exclusive Sections of the Report (The USPs):

- PROCEDURE & MODALITY UTILIZATION METRICS – helps you understand demand patterns by analyzing global and regional procedure volumes, hospital vs outpatient growth rates, and modality-specific usage trends across X-ray, CT, MRI, ultrasound, and fluoroscopy.

- PATIENT DEMOGRAPHICS & ACCESSIBILITY INDEX – helps you evaluate market needs by examining age and gender distribution, urban–rural utilization gaps, and the role of insurance coverage in driving orthopedic imaging adoption.

- EQUIPMENT OWNERSHIP & INFRASTRUCTURE CAPACITY SCORE – helps you assess the expansion of imaging capabilities through insights on ownership patterns, annual installation volumes, facility size distribution, and staff-to-equipment readiness ratios.

- REIMBURSEMENT & PAYER MIX LANDSCAPE – helps you gauge financial viability by comparing reimbursement contributions from Medicare, Medicaid, private payers, and out-of-pocket segments, along with differences in rates between hospitals and outpatient centers.

- COST & PRICING DYNAMICS BENCHMARK – helps you evaluate economic competitiveness by tracking procedure cost variations, price differences across major imaging modalities, and cost savings enabled by digital and AI-driven imaging technologies.

- COMPETITIVE POSITIONING & TECHNOLOGY ADOPTION INSIGHTS – helps you identify leading players and emerging innovators through analysis of new system installations, AI-integrated workflows, and modality-specific advancements shaping market differentiation.

Related Reports

Medical Imaging Devices Market

Digital Radiology Market

AI In Medical Imaging Market

Digital X-Ray Systems Market

Ultrasound Equipment Market

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK) Email: info@snsinsider.com

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.