The U.S. Lithium Iron Phosphate Batteries Market is expected to rise at a CAGR of 16.00% from 2026 to 2033, reaching USD 32.27 billion by 2033. Stronger needs for clean transportation and renewable energy are fueling the expansion of the lithium iron phosphate (LiFePO₄) batteries industry in the U.S.

Austin, Dec. 02, 2025 (GLOBE NEWSWIRE) — Lithium Iron Phosphate Battery Market Size & Growth Insights:

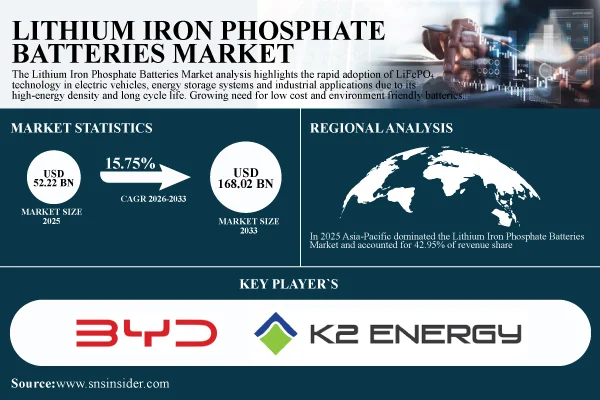

According to the SNS Insider,“The Lithium Iron Phosphate Batteries Market size was valued at USD 52.22 Billion in 2025E and is projected to reach USD 168.02 Billion by 2033, growing at a CAGR of 15.75% during 2026-2033.”

Rising Electric Vehicle Adoption Boost Market Expansion Globally

LiFePO₄ batteries are becoming more and more necessary in the market for electric vehicles (EVs), which includes renewable energy storage systems. When compared to alternative chemistries, they offer advantages in terms of safety, thermal stability, long cycle life, and cost effectiveness. The industry is still expanding due to a combination of favorable government policies and subsidies for renewable energy, as well as growing industrial and consumer uses. Fast charging and higher battery energy density are examples of ongoing scientific advancements that enhance battery performance and promote adoption in the automotive, energy storage, and other industrial sectors globally.

Get a Sample Report of Lithium Iron Phosphate Battery Market Forecast @ https://www.snsinsider.com/sample-request/8931

Leading Market Players with their Product Listed in this Report are:

- BYD Company Ltd.

- A123 Systems LLC

- K2 Energy

- Electric Vehicle Power System Technology Co. Ltd.

- Bharat Power Solutions

- OptimumNano Energy Co. Ltd.

- k2battery

- LiFeBATT Inc.

- LITHIUMWERKS

- CENS Energy Tech Co. Ltd.

- RELiON Batteries

- Contemporary Amperex Technology Co. Limited (CATL)

- Gotion High-Tech

- CALB (China Aviation Lithium Battery Co. Ltd.)

- EVE Energy Co. Ltd.

- LG Energy Solution

- Panasonic Corporation

- Samsung SDI

- Sunwoda

- BSLBATT

Lithium Iron Phosphate Battery Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 52.22 Billion |

| Market Size by 2033 | USD 168.02 Billion |

| CAGR | CAGR of 15.75% From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Power Capacity (16,250 mAh, 16,251–50,000 mAh, 50,001–100,000 mAh, and 100,001–540,000 mAh), • By Application (Portable, Stationary, and Others) • By Voltage (Up to 3.2 KV, 3.2–12 KV, 12–20 KV, and Above 20 KV) • By End-Use Industry (Automotive, Power, Industrial, and Others) |

Purchase Single User PDF of Lithium Iron Phosphate Battery Market Report (20% Discount) @ https://www.snsinsider.com/checkout/8931

Key Industry Segmentation

By Power Capacity

50,001–100,000 mAh segment led the market with a 38.50% share owing to such features as an optimum combination of capacity and reliability and easy use in a EVs and industrial purposes. 100,001–540,000 mAh segment registered the fastest growth, with a CAGR of 11.80% as need increases for utility energy storage systems, grid support and commercial applications.

By Application

The stationary batteries dominated the market with a 46.20% share in 2025 due to grid and commercial energy storage system have been predominant now and their long cycle life and stable performance. The portable batteries were the fastest growing segment, recording a CAGR of 12.40% influenced by increasing need of mobile power systems, smaller battery packages and high energy batteries in lighter weight devices.

By Voltage

3.2–12 KV segment led with a 42.70% share owing to the increasing needs for EVs batteries in both emerging and developed markets. 12–20 KV segment grew fastest at a CAGR of 10.90% as it is more and more used in high-power industrial applications, utility-scale energy storage systems, as well as heavy-duty EVs.

By End-Use Industry

The automotive sector held 21.60% of the market in 2025 owing to the growing adoption of EVs, penetration of hybrid vehicles and fleet electrification. The power segment registered the fastest growth with a CAGR of 11.60% owing to the increasing attention toward sustainable energy solutions, government incentives for the adoption of renewable energy generation in developing economies, and rising demand for industrial electricity storage.

Regional Insights:

In 2025, Asia Pacific dominated the Lithium Iron Phosphate Batteries Market and accounted for 42.95% of revenue share, this leadership is driven by the increasing EV penetration and rising renewable energy initiatives.

North America is expected to witness the fastest growth in the Lithium Iron Phosphate Batteries Market over 2026-2033, with a projected CAGR of 16.43% due to increase in EV production, renewable energy storage and industrial applications.

Do you have any specific queries or need any customized research on Lithium Iron Phosphate Battery Market? Schedule a Call with Our Analyst Team @ https://www.snsinsider.com/request-analyst/8931

Recent News:

- In April 2025, BYD and Saudi Aramco signed a Joint Development Agreement to collaborate on new energy vehicle technologies, aiming to enhance efficiency and environmental performance in the automotive sector. The partnership also focuses on advanced battery integration, sustainable materials, and future mobility solutions across global markets.

- In September 2025, A123 Systems introduced its next-generation energy storage portfolio at RE+ 2025, featuring the AEnergy™ 5000 and AEnergy™ 850 platforms designed for utility, commercial, and microgrid applications in North America. These platforms provide improved safety, faster charging, longer lifecycle, and higher energy density, supporting renewable energy adoption and grid stability initiatives.

Exclusive Sections of the Lithium Iron Phosphate Battery Market Report (The USPs):

- PERFORMANCE & SAFETY BENCHMARK METRICS – helps you evaluate real-world battery reliability by analyzing cycle life improvements, thermal stability advantages, charge/discharge efficiency, and safety performance compared with other chemistries.

- COST COMPETITIVENESS & MANUFACTURING ECONOMICS – helps you understand how lower material costs, simplified production steps, and reduced cobalt/nickel dependency improve pricing structures and overall cost-per-kWh across regions.

- SUPPLY CHAIN MATERIAL SECURITY INDEX – helps you identify vulnerabilities and strengths in raw material availability by tracking phosphate sourcing, domestic vs imported cell/module share, and exposure to geopolitical disruptions.

- TECHNOLOGY ADOPTION & APPLICATION EXPANSION RATE – helps you uncover high-growth segments by evaluating uptake of LFP batteries in EVs, energy storage systems, e-mobility platforms, and emerging industrial applications.

- REGIONAL MANUFACTURING CAPACITY & POLICY IMPACT – helps you assess how government incentives, local production mandates, and gigafactory expansions shape regional dominance and long-term market positioning.

- COMPETITIVE LANDSCAPE & INNOVATION LEADERSHIP – helps you compare major players based on production capacity, product portfolio, R&D advancements, and strategic partnerships driving next-generation LFP technologies.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.