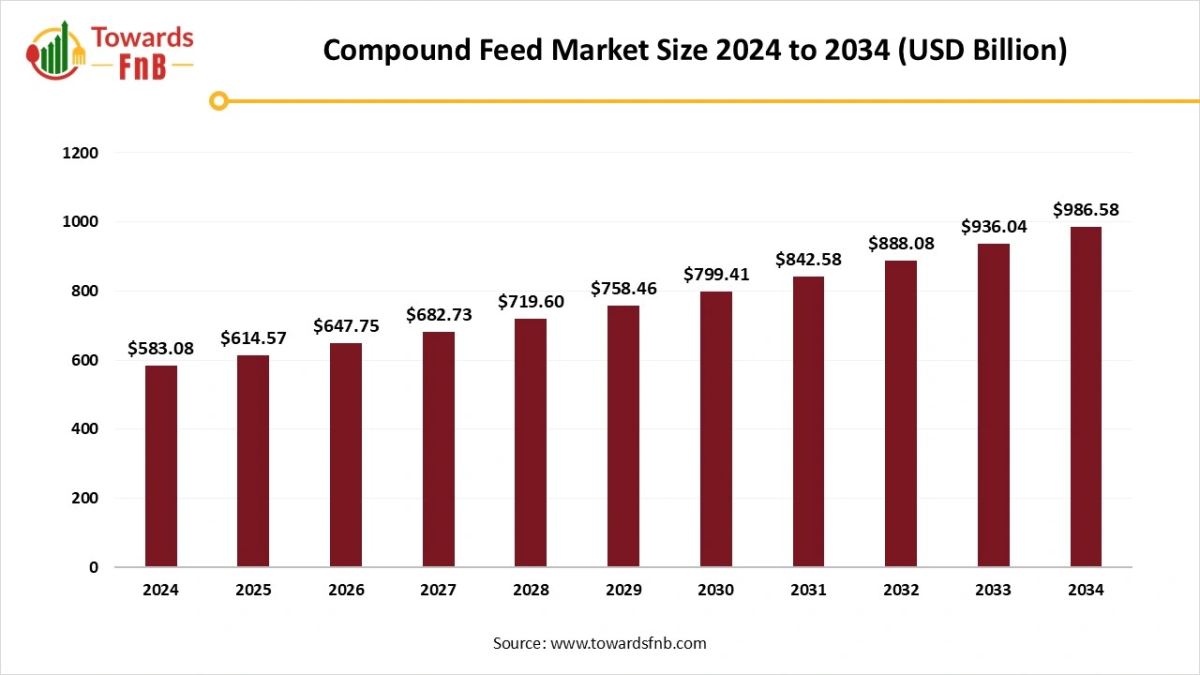

According to Towards FnB, the global compound feed market size is evaluated at USD 614.57 billion in 2025 and is anticipated to surge USD 986.58 billion by 2034, reflecting at a CAGR of 5.4% from 2025 to 2034. This growth is largely driven by the increasing demand for animal protein, rising incomes in emerging economies, and a heightened focus on providing nutritional balance for livestock.

Ottawa, Dec. 02, 2025 (GLOBE NEWSWIRE) — The global compound feed market size was valued at USD 583.08 billion in 2024 and is predicted to grow from USD 614.57 billion in 2025 to reach around USD 986.58 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The demand for compound feed is being driven by the developing worldwide consumption of animal protein, rising incomes, growing global consumption in developing economies, and the need for nutritional balance in livestock manufacturing.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5811

Key Highlights of the Compound Feed Market

- By region, Asia Pacific led the compound feed market in 2024 with a 33% share, supported by the expansion of the animal population.

- By region, Latin America is anticipated to be the fastest-growing region during the forecast period, driven by rising demand for natural and plant-based animal feed products.

- By ingredient, the cereals segment accounted for roughly 45% of the market in 2024, supported by its high starch content.

- By ingredient, the additives segment is expected to grow steadily from 2025 to 2034, fueled by increasing consumer emphasis on animal health and performance.

- By animal type, the poultry segment captured 40% of the market in 2024, driven by rising meat consumption.

- By animal type, the aquaculture segment is projected to expand at a healthy CAGR from 2025 to 2034, supported by growing demand for nutrient-dense, formulated feeds.

- By form, the pellets dominated the market in 2024 with a 50% share, driven by rising livestock production needs.

- By form, the crumbles are expected to grow at a notable CAGR between 2025 and 2034, due to increasing demand for feed suitable for young or small animals.

- By distribution channel, the feed mills and cooperatives held a 55% share in 2024, underpinned by the heightened focus on animal health and performance.

- By distribution channel, the online platforms are projected to grow significantly from 2025 to 2034, supported by rising consumer preference for online animal feed purchases.

- By end use, the commercial livestock farms accounted for 60% of the market in 2024, driven by the need for high-quality livestock production.

- By end use, the aquaculture producers are expected to see strong CAGR growth from 2025 to 2034, fueled by increasing consumer demand for fish.

Compound Feed Market Overview and Historical Development

Compound the feed that is produced on the foundation of animals in various growth stages, as different physiological needs and various manufacturing uses, as well as the research and experiment on the checking of feed nutrition value, and as per the scientific formula, which is a mixed feed of various sources evenly in a particular ratio and processed by the directed technology.

The manufacturing of compound feed started back in the early twentieth Century, since the year 1950, as the agreement of the demands of amino acids, trace elements, and vitamins of the domestic animals is becoming more precise.

Major Importers of the Compound Feed:

- Worldwide, the leading three importers of Compound Feed are Kazakhstan, Russia, and Vietnam. Russia has topped the globe in terms of Compound Feed imports with 5,933 shipments, followed by Kazakhstan, which has 1,682 shipments, and Vietnam, which has taken the third spot with 1,536 shipments.

- As per the global data of Volza, the globe has imported 6,843 shipments of the Compound Feed during the period October 2023 to September 2024. These imports were being supplied by 841 exporters to 960 Worldwide buyers, who have marked a growth rate of around -6% as compared to the previous twelve months.

- During this period, the globe has imported 718 compounds in the month of September 2024.

New Trends in the Compound Feed Market:

- Precision Feeding: Personalized Nutrition for Livestock: Precision feeding is updating the way livestock are cultivated. By tailoring diets to the particular demands of every animal, precision feeding grows productivity while reducing waste. This strategy develops technology and data to check the correct nutritional needs of livestock based on their weight, age, production aim, and health status.

- Smart Farming Technologies: Transforming Feed Management: Smart farming technologies are changing the animal feed industry by implementing automation and digital tools into the feed management procedure. From actual-time tracking to predictive analytics, such technologies allow farmers to make data-driven decisions that develop fertility and reduce costs, too.

- Alternate protein sources: The growth of Sustainable Feed Ingredients: The exploration for sustainable and value-driven feed ingredients has led to the growth of alternative protein sources. These cutting-edge ingredients are crafted to lower dependency on regular feed materials like fishmeal and soy, which are resource-intensive to generate. Algae-based feed is being packed with necessary nutrients and the omega-3 fatty acids, which are being excessively used in livestock farming and aquaculture.

- Concentrate on Sustainability: Environment-friendly Feed Practices: Sustainability is at the forefront of the animal feed sector in 2025. Producers and farmers are accepting eco-friendly applications to reduce the environmental effects of feed production and usage, too. Farmers accepting sustainable feed practices often found that such updates meet with user choice for ethically manufactured animal products, which makes it possible for luxury pricing.

- Regional and Global Partnership for Feed Invention: The animal-feed sector is increasingly concentrating on global and regional partnerships in order to drive discovery. Collaborations between the feed manufacturers, research institutions, and farmers are driving the advancement of the latest feed solutions that solve local issues.

- Enhanced Feed Additives for Livestock Health: One can develop gut health by marketing advantageous bacteria, reducing the risk of gastrointestinal issues, and improving digestion, too. Also, enzymes increase the digestibility that enables livestock to generate higher nutritional value from their diets. Lastly, the phytogenics, which are plant-based additives that help grow immunity, lessen stress, and improve overall health without depending on antibiotics.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/compound-feed-market

Recent Developments in the Compound Feed Market

- In March 2025, Kemin Industries, which is a top Ingredient producer that depends sustainability to improve the quality of life each day to 80% of the world with its products and services, has currently revealed a new feed pathogen control solution named PROSIDIUM in Bangkok, which is Asia’s biggest feed and animal manufacturing tradeshow.

- In April 2025, Nectar Origin,an agri-invention, was delighted to introduce its highly acclaimed flagship item, named Manka Cattle Feed -an innovative and science-dependent cattle nutrition product crafted to update dairy productivity in India and abroad.

- In July 2025, Corbion successfully protected multiple regulatory approvals from China’s General Administration of Customs 9GACC) that paved the path for the revelation of its algae-derived omega-3 DHA products into China’s rapidly developing human and animal nutrition markets.

- In November 2025, an Australian organization is revealing an new facility in the UAE that will start processing surplus bread and grain-processing waste into sustainable animal feed that assists the country in lowering the annual food waste, which is calculated at 13 billion dirhams (USD 3.54 billion).

World’s Top 10 Feed Companies:

| Company | Country | Feed Production ( *1000 metric tones ) |

| Haid Group | China | 21740 |

| New Hope Group | China | 28740 |

| CP Group | Thailand | 17175 |

| Cargill | United States | 17500 |

| Shuangbaotai Group (Twins Group) | China | 14500 |

| Wen’s Food Group | China | 15000 |

| Tyson Foods | United States | 12600 |

| Land O’Lakes | United States | 13500 |

| De Heus | Netherlands | 12300 |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5811

Compound Feed Market Dynamics

Market Driver: Rising Demand for High-Quality Animal Protein

The global compound feed market is driven by the rising demand for high-quality animal protein, supported by population growth, urbanization, and increasing disposable incomes. Livestock producers are increasingly adopting nutritionally balanced and standardized feed solutions to improve animal health, boost productivity, and comply with stringent food safety regulations. This shift toward efficient feed management continues to propel the market’s growth.

Market Restraint: Raw Material Price Volatility and Regulatory Pressure

One of the major restraints for the compound feed market is the volatility in raw material prices, particularly grains, oilseeds, and feed additives. These fluctuations often influenced by climate variability, geopolitical tensions, and global supply chain challenges make cost planning difficult for manufacturers. Furthermore, stringent regulatory requirements related to feed formulation and additive use can increase operational and compliance costs, posing additional obstacles for feed producers.

Market Opportunity: Growing Demand for Specialty and Sustainable Feed Solutions

The compound feed market presents significant opportunities through the increasing demand for specialized feed formulations such as organic, antibiotic-free, and species-specific feeds. Growing consumer awareness around animal welfare and sustainable food production is encouraging manufacturers to innovate and develop environmentally friendly feed solutions. Additionally, expanding livestock production and rapid modernization in emerging markets across Asia, Africa, and Latin America are creating new avenues for market growth.

Major Technology Advancements in the Compound Feed Market:

AI can update feed recipes for livestock such as pigs and cows, by pushing efficiency and aligning with nutritional demands at each growth stage. It expects the perfect mixture of ingredients to receive needed energy, protein, and nutritional profiles, which assists in formulating feeds more quickly and ensures quality standards, too.

Its advantages expand beyond the formulation to manufacturing, in which it predicts optimal manufacturing elements, resulting in significant cost savings and decreased waste, too.

The AI-allowed software can update feed composition depending on animal need, track inventory by guessing user demand, and combine feed manufacturing and ingredient purchasing.

For instance, to this

- In November 2025, Orffa, which is a leading producer of specialty feed additives, revealed its updated aim, mission, and vision, distilled into a latest brand promise named ” Orffa: The Science in our Feed”.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Compound Feed Market Regional Analysis

The Asia Pacific Dominated the Compound Feed Market in 2024, the growth is driven by many factors, which include developing incomes, updated dietary designs, and the fast urbanisation that gives importance to animal protein usage. With big populations in countries like India and China that are heavily accepting Western diets, the urge for meat, dairy, and eggs has grown, making a parallel demand for good-quality and cost-effective animal feed.

The industry growth is being supported by a move towards intensive farming procedure that needs more standard and personalised feed solutions for both aquaculture and livestock.

Growing Compound Feed Market in China

In China, the compound feed industry is developing due to growing meat consumption and the modernization and urbanization of the compound feed market. Main trends that lead to growth are increased concentration on feed smoothness, production consolidation, and acceptance of alternate protein sources, and the mixing of new technologies, such as Artificial Intelligence. On the other hand, the aquafeed production is witnessing fast growth as China continues to expand its aquaculture sector. Personalized feeds for the seawater fish and the particular freshwater species are developing particularly quickly.

For instance, to this

- In June 2025, Worldwide feed manufacturing is expected to increase by 1.2 % year-on-year to 1.396 billion tons in 2024, which has species and regional related trends that displayed both persistent and strength disease-linked issues, as per the year 2025 Alltech Agri-Food update.

The Latin America is Predicted to Be a Notable Region in the Foreseeable Period

Users and export markets in the Thai region are heavily urging higher standards for animal welfare and environmentally responsible manufacturing. This is encouraging producers towards a more standard sourcing, lowered antibiotic usage, and the growth of sustainable, natural alternatives to regular additives. Also, the efforts to lower the surrounding effect, along with supply chain dislocation, are marketing the usage of local ingredients and alternative protein sources too.

Growing Compound Feed Market in Brazil:

The Brazilian compound feed sector is experiencing fast development, which is being driven by the nation’s exceptional livestock sector and developing demand for good-quality animal protein. Brazil’s position as a main leader in the beef and poultry exports is meeting the demand for tailored feed formulations to develop animal productivity and health. Consumers are heavily finding nutrient-dense meat, dairy products, and eggs, too, which leads farmers to depend on compound feed to align with these demands.

For instance, to this

- In April 2025, Brazil’s animal feed sector is expected to develop by 2.3% 2025 as per the current USDA FAS forecast.

Compound Feed Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 5.4% |

| Market Size in 2025 | USD 614.57 Billion |

| Market Size in 2026 | USD 647.75 Billion |

| Market Size by 2034 | USD 986.58 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Compound Feed Market Segmental Analysis

Ingredient Analysis

The Cereals Segment has dominated the Compound Feed Market in 2024

As cereals play a crucial role in serving necessary nutrients for human diets. Hence, most cereal crops are being processed for animal feed purposes, the making of other food products or components, as well as industrial uses. The cereal grains and the whole grain cereal products are high sources of biologically active compounds such as dietary fibers ( eg, alkylresorcinols, tocotrienols, and phenolic acids, microelements, and fibrous polymers too).

The Additives Segment is Expected to Rise Fastest During the Forecast Period

Animal-fed additives are tailored substances integrated with animal diets to develop nutritional value and improve health outcomes. According to research, these updated manufacturing performances go beyond what basic feed ingredients can provide. Just like initial primary feed ingredients, such as protein meals and grains, these additives operate at minute addition rates to serve particular functional advantages that assist animal wellbeing and productivity.

Animal Analysis

How did Poultry Segment Dominate the Compound Feed Market?

The poultry segment dominated the in 2024, because current poultry nutrition depends intensely on feed supplements for poultry, which are the base of the industry, that reaches way beyond the reach and encouragement of simple feed ingredients. Framers add these personalized substances to the poultry diets to develop bird development smoothness, prevent disease, improve egg-laying potential, and improve the feed usage.

Feed items filled with probiotics, prebiotics, and the immune-boosting compounds assist in protecting against prevalent infections and lower the use of antibiotics.

The Aquaculture Segment is Expected to Rise Fastest During the Forecast Period

They are also known as aquafeeds, as feeds utilised to farm aquatic species. The semi-commercial feeds consist of a number of ingredients that are mixed in different ratios to complement one another and create a simple compound feed. These feeds are produced by using simple manufacturing technologies like grinding, cooking, and drying, and are spread and sold via local market chains.

Form Analysis

The Pellets Segment Dominated the Compound Feed Market in 2024

As pellets acts as a mash but are being processed further by adding heat and pressure to create uniform and compact pieces. This procedure assists in locking in nutrients and makes the feed convenient for animals to consume. Every pellet contains the correct balance of nutrients, so every animal gets an overall diet in every mouthful. Pellets are clear and convenient to store, which makes feeding easy and smoother. They also have lower mess as compared to lose mash.

Supplying pellets with whole grains can develop any laying hens’ diet with additional energy source in the winter months or serve at any time of the year. Scratch feed can also be affixed to supplement, which is frequently a mixture of whole grains and can include barley, corn, wheat, sunflower seeds, and field peas, too.

The Crumbles Segment is Expected to Rise Fastest During the Forecast Period

Crumbles are a design of compound feed made by crushing pellets into minute, irregularly shaped particles. This procedure makes the feed convenient for smaller animals, such as tongue chicks, to consume and digest. The little particle size, which is convenient for younger and smaller animals to eat, leads to developed feed consumption and faster development rates as compared to mash feed.

Distribution Channel Analysis

The Feed Mills and Co-operatives Segment Dominated the Compound Feed Market in 2024

As the journey starts with the reception of raw materials. Here, current bulk material carrying technologies come into the forefront. Materials that come with the feed mill experience careful checking and quality checks, too. Sampling processes are used to collect representative samples for testing.

The material handling machines used here, such as bucket elevators, conveyors, and hoppers, should be capable of handling various materials smoothly.

The Online Platform Segment is Expected to Rise Fastest During the Forecast Period

Online platforms spread compound feed with the assistance of different channels that include business-to-business (B2B) marketplaces, which are specialized e-commerce sites, digital tools for handling the supply chain, and direct-to-farmers platforms too. While the online retail is a developing segment, especially among the minute holder farmers, regular channels such as sales and co-operatives stay dominant for bigger commercial operations.

End-User Analysis

The Commercial Livestock Farms Segment has dominated the Compound Feed Market in 2024

As they use compound feed to serve effectively balanced nutrition personalised to particular animal feeds that develop productivity, develop animal health, and ensure the consistency and quality of the outcome products. This strategy substitutes regular and frequent feeding with an accurate and cost-effective machine.

Nutrients are being allocated depending on particular manufacturing needs of pregnant animals that are high-yielding animals that receive additional supplements.

The Aquaculture Producers Segment is Expected to Rise Fastest During the Forecast Period

Feed should match the demands of a well-balanced and accurate diet for every species of fish grown on the aquaculture farms that respects the nutritional needs. Hence, while selecting feed, the macronutrients such as lipids, proteins, carbohydrates, and fiber are also counted as crucial, as well as some of the micro-nutrients, necessary vitamins, fatty acids, minerals, and vitamins too.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Compound Feed Market Top Companies:

- Adisseo

- Advanced Enzyme Technologies Ltd.

- BASF SE

- Cargill, Inc.

- DuPont (IFF)

- Evonik Industries AG

- Novozymes A/S

- Kemin Industries

- DSM Nutritional Products

- Lallemand Animal Nutrition

- AB Enzymes GmbH

- Alltech

- BBI Enzymes

- Puratos Group

- Nutrex NV

- Biovet, S.A.

- Oriental Yeast Co., Ltd.

- Verenium Corporation

- Kitech

- Enzyme Development Corporation

Segments Covered in the Report

By Ingredient Type

- Cereals (Corn, Wheat, Barley, Sorghum)

- Oilseed Meals (Soybean Meal, Rapeseed Meal, Sunflower Meal)

- By-products (Distillers Dried Grains, Bran, Molasses)

- Additives (Vitamins, Minerals, Amino Acids, Enzymes, Probiotics)

By Livestock/Animal Type

- Poultry (Broilers, Layers, Others)

- Swine

- Ruminants (Dairy Cattle, Beef Cattle, Sheep & Goats)

- Aquaculture (Fish, Shrimp, Others)

- Pets & Others

By Form

- Pellets

- Crumbles

- Mash

- Others (Extruded, Liquid Supplements)

By Distribution Channel

- Direct Sales to Farms

- Feed Mills & Cooperatives

- Distributors / Dealers

- Online Platforms

By End-User

- Commercial Livestock Farms

- Smallholder Farmers

- Aquaculture Producers

- Pet Owners

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5811

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

LinkedIn | Medium| Twitter

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.