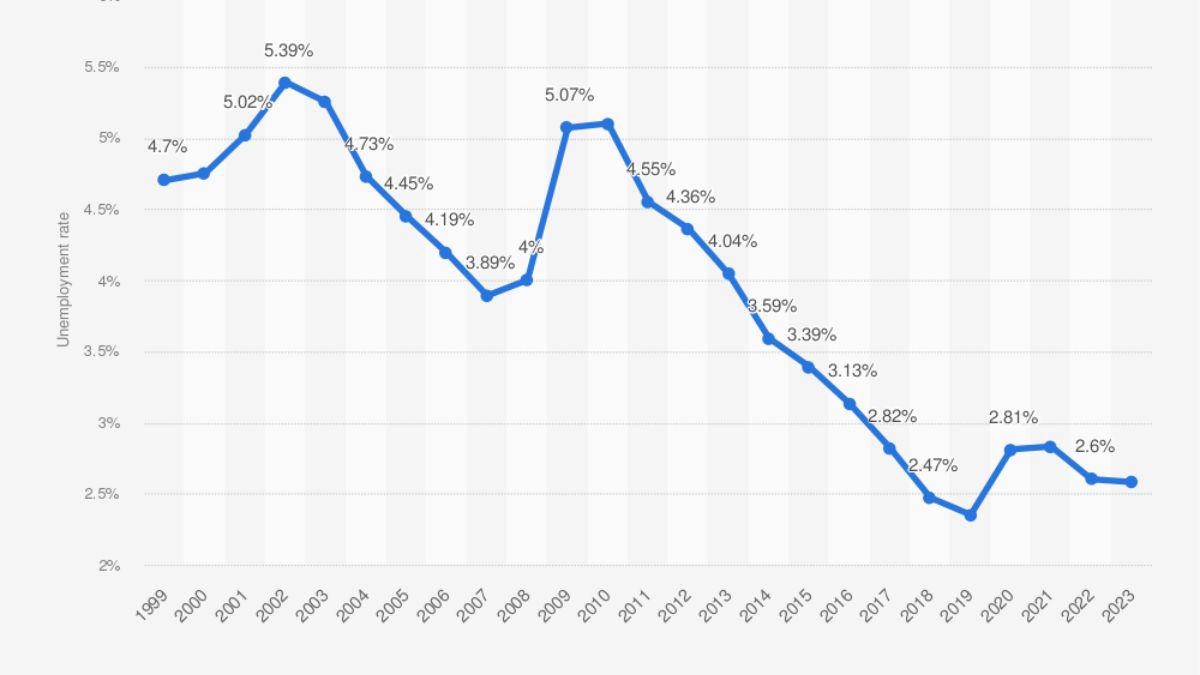

Japan’s employment rate: A snapshot of economic resilience

The employment landscape in Japan is shaped significantly by its aging population, with a growing percentage of the workforce approaching retirement age. This demographic shift poses unique challenges, particularly in maintaining a robust labor pool. To counteract these issues, the government has been actively promoting policies aimed at encouraging higher participation rates among women and older workers. Recent initiatives, such as enhancing childcare support and improving working conditions for seniors, have been introduced to bolster employment rates in these demographics.