Image credits - AUTO Futurs

Image credits - AUTO Futurs

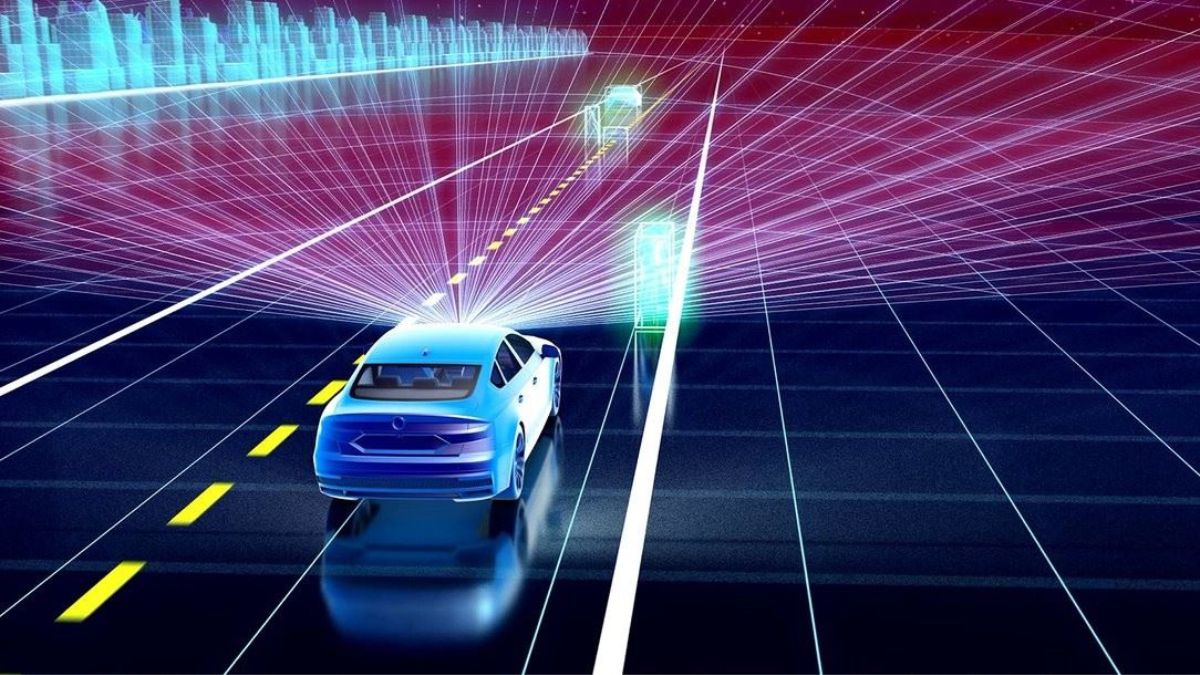

China’s prowess in the electric vehicle (EV) sector is extending beyond just vehicles—its dominance in lidar technology, crucial for self-driving capabilities, is now taking centre stage. Lidar systems, advanced sensors emitting laser beams to precisely measure distances to surrounding objects, are becoming integral for achieving fully automated driving.

According to Tokyo-based Patent Result, Chinese companies have filed a staggering 25,957 patent applications related to lidar since 2000, surpassing American and Japanese companies with 18,821 and 13,939 applications, respectively. Germany’s Bosch leads in patent applications, with Japanese auto parts supplier Denso following closely. However, China’s RoboSense and Hesai Technology secure the fourth and fifth positions, showcasing a remarkable surge in their numbers since 2015.

In 2022, Hesai emerged as the leader in the automotive lidar market, claiming a 47% share, according to French research firm Yole. There are two primary types of lidar—those for fully automated driving and those for driver assistance. Hesai excels in lidar for fully automated driving, with high unit costs, and supplies major players like GM Cruise and China’s Baidu.

Meanwhile, RoboSense specializes in cost-effective lidar for driver assistance and experienced a surge in sales, delivering 57,000 units in 2022. Notably, Chinese automakers like Zhejiang Geely Holding Group and Xpeng Motors have chosen RoboSense’s products for their vehicles.

Xpeng, for instance, introduced an EV equipped with two RoboSense lidar units, enhancing driving assistance on both general roads and highways. Yole predicts that over 100 lidar-equipped models will launch in the Chinese market between 2023 and 2025, showcasing the rapid integration of lidar technology.

In contrast, Japan, the U.S., and Europe lag in lidar adoption. The focus on EV development has led to a gap in automated driving technology. Struggling lidar developers in these regions face challenges, with Bosch discontinuing lidar development to prioritize other sensors in high demand, such as radio wave radar for Level 2 automated driving.

As China continues to lead the charge in lidar innovation, the landscape of autonomous driving technology is undergoing a significant transformation, with Chinese companies driving advancements that extend beyond domestic borders.