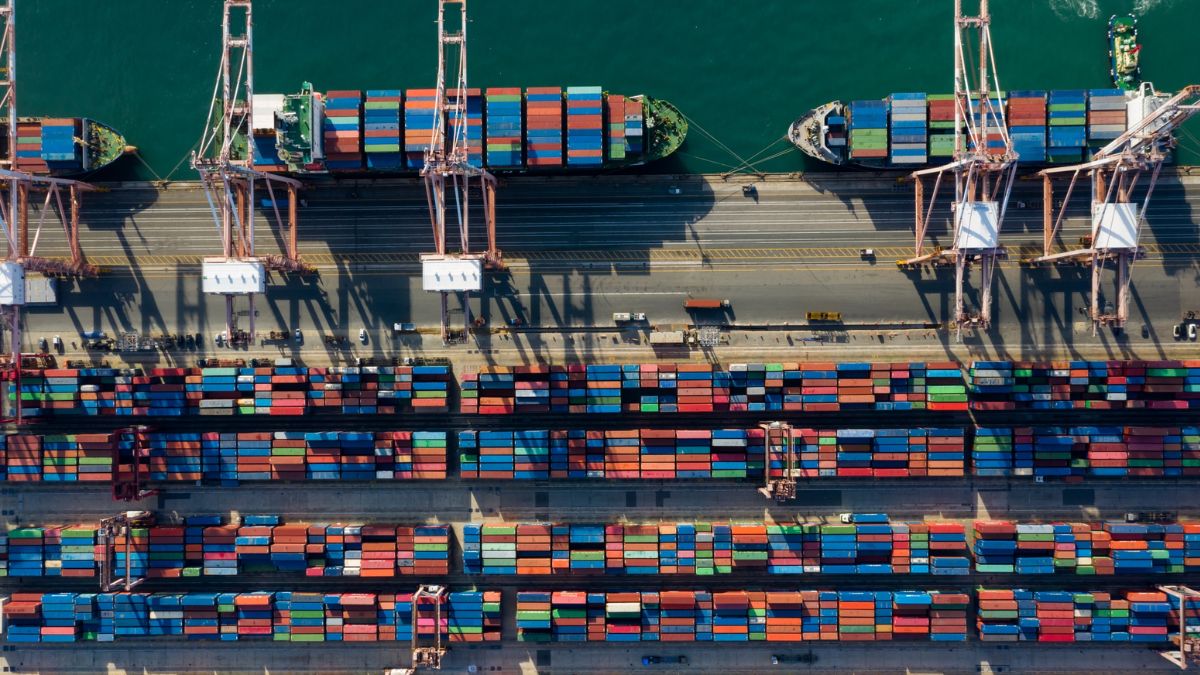

South Korea is one of the world’s biggest exporters of goods, making it an important indicator of the state of global trade. The country is especially dominant in exporting memory chips and smartphones, so its performance serves as a gauge of global demand for technology products.

The country’s exports showed positive growth of 5.1% year-over-year in October 2023, marking the first increase since September 2022. This rebound in exports was driven by strong performance in sectors like automobiles and petroleum products.

After over a year of consecutive declines, South Korea’s chip exports experienced a resurgence in positive growth in November 2023. This upturn has been fueled by rising memory chip prices amid increasing demand from emerging technologies such as artificial intelligence.

The revival in South Korea’s exports, particularly in the crucial semiconductor segment, signals an improving outlook for the country’s trade-dependent economy and the broader tech industry after a prolonged downturn.

However, some key risks remain for South Korea’s export-oriented manufacturing sector. Weak economic growth in the European Union and sluggish domestic demand within mainland China during 2024 pose a downside risk. South Korea’s exports to mainland China have remained subdued, declining by 9.5% year-over-year in October 2023.

However, South Korea’s tourism sector has been on the rise throughout 2023 and is anticipated to continue its upward trajectory into 2024. This is supported by the continued recovery in international tourist travel within the Asia-Pacific region.

The latest South Korean export data signals continued recovery in worldwide demand, particularly for chips. In March 2024, South Korea’s chip exports jumped 35.7% from a year earlier to reach $11.7 billion – the highest monthly chip export value since March 2022.

South Korea’s total exports expanded by 3.1% year-on-year in March 2024, though the growth rate slowed compared to the previous month’s 4.9% yearly increase. The value of South Korea’s total exports reached $56.6 billion in March 2024. On the other hand, South Korea’s total imports recorded a decline, falling by 12.3% year-on-year to $52.3 billion in March 2024. Despite the import contraction, South Korea managed to maintain a trade surplus of $4.3 billion in March 2024 as exports outpaced imports during the month.

Exports of displays rose 16.2% and computer exports increased 24.5% as well in March. This highlights the robust momentum driven by strong global demand for technology products.

After experiencing a yearlong slump, South Korea’s exports finally started rebounding towards the end of 2023. This recovery came as global demand picked up for South Korean products across various sectors like electronics, automobiles, petrochemicals, and shipbuilding.

As 2024 progresses, a key focus will be on gauging the strength of chip demand and its potential to drive economic growth in South Korea as well as neighbouring countries like Taiwan and Vietnam that are part of the semiconductor supply chain.

According to base-case forecasts by the Korea International Trade Association, South Korea’s exports are expected to grow by 7.9% in 2024, reaching $680 billion for the year. On the imports side, the trade association projects a 3.3% increase in 2024. With exports growing at a faster pace than imports, South Korea is forecasted to record a trade surplus of $14 billion in 2024.

South Korean exports are projected to see robust growth of nearly 8% in 2024, outpacing an expected moderate increase in imports, thereby resulting in a healthy $14 billion trade surplus for the country based on the trade association’s base-case scenario.