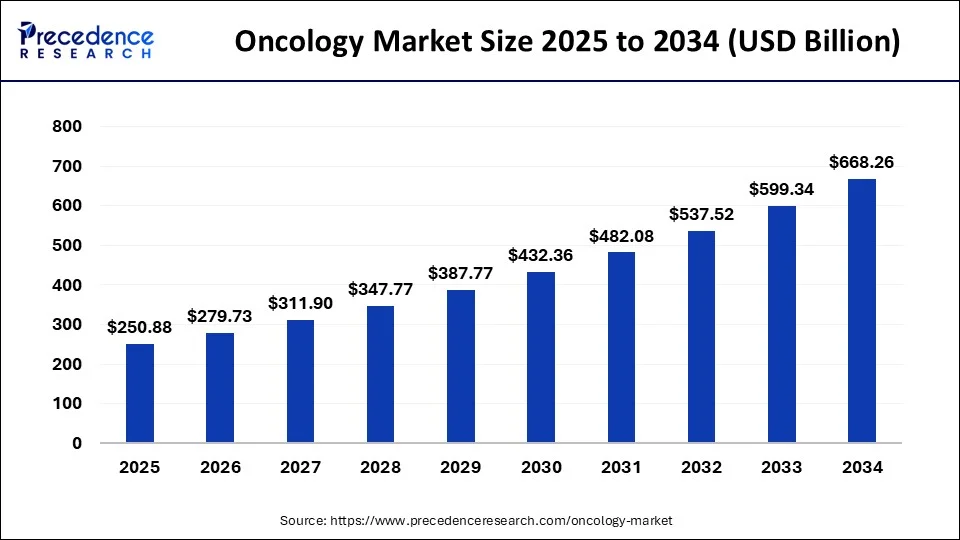

According to Precedence Research, the global oncology market size was valued at USD 250.88 billion in 2025 and will grow from USD 279.73 billion in 2026 to nearly USD 668.26 billion by 2034, with an expected CAGR of 11.50% from 2025 to 2034.

Ottawa, Dec. 02, 2025 (GLOBE NEWSWIRE) — The global oncology market size is expected to be worth over USD 668.26 billion by 2034, increasing from USD 279.73 billion in 2026, growing at a strong CAGR of 11.50% between 2025 and 2034. The growing number of cancer patients and the development of cancer treatments drive the market growth.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1467

Oncology Market Key Takeaways

- In terms of revenue, the oncology market was calculated at $250.88 billion in 2025.

- It is projected to cross $668.26 billion by 2034.

- The oncology market is expected to expand at a strong CAGR of 11.50% from 2025 to 2034.

- North America dominated the global market by holding more than 46% of the total market share in 2024.

- The cancer treatment segment held the largest market share of 56% in 2024.

- By indication, the lung cancer segment contributed the highest market share in 2024.

- The hospital segment is growing at a notable CAGR of 10.9% from 2025 to 2034.

Oncology Market Overview

The oncology market growth is driven by increasing cancer incidence in elderly people, the development of novel cancer therapies, the rise in precision medicine, the adoption of minimally invasive procedures, and the growing risk of diverse cancers.

Oncology is a type of medicine dedicated to the diagnosis, management, prevention, and treatment of cancer. Oncology offers diverse therapies for cancer, like chemotherapy, radiation therapy, surgery, and immunotherapy. The various oncology specialists are patient navigators, genetic counsellors, oncology nurses, and social workers. Oncology offers benefits like symptom relief, curative care, tumor control, organ preservation, and personalised care.

➡️ Become a valued research partner with us https://www.precedenceresearch.com/schedule-meeting

Major Government Initiatives for Oncology:

- US National Cancer Act of 1971: This landmark legislation expanded the National Cancer Institute’s (NCI) authorities and funding to coordinate and lead the national effort against cancer, establishing the modern US cancer research and treatment community.

- US Cancer Moonshot Initiative: Relaunched in 2022 by President Joe Biden, this initiative aims to cut the age-adjusted cancer death rate by at least 50% over 25 years and improve the experience for patients and survivors.

- India’s Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (PM-JAY): This scheme provides financial protection to vulnerable families, offering up to ₹5 lakh per year for secondary and tertiary care hospitalization, including comprehensive cancer treatment, at empanelled public and private hospitals.

- India’s National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS): This program focuses on strengthening infrastructure for health promotion, early diagnosis, and management of common cancers (oral, breast, and cervical) at the community level.

- India’s National Cancer Grid (NCG): The NCG connects major cancer centers, research institutes, and patient advocacy groups to standardize high-quality, evidence-based cancer care across India and facilitate collaboration in research and treatment protocols.

- UK’s National War on Cancer (2022): This 10-year plan aims to transform the UK’s cancer care system by intensifying research on new early diagnostic tools and improving the prevention, diagnosis, and treatment of cancer.

- Quad Cancer Moonshot Initiative: Launched by India, the US, Australia, and Japan, this global collaboration focuses on eliminating cervical cancer across the Indo-Pacific region through scaled-up screening and vaccination programs and shared research.

- NCI’s Affordable Cancer Technologies (ACTs) Program: This NCI program supports the development of cost-effective, resource-appropriate technologies for cancer prevention, diagnosis, and treatment specifically for low- and middle-income countries and low-resource settings.

✚ Turn AI disruption into Opportunity. Click to Get the Insights Shaping Tomorrow.

What are the Key Trends of the Global Oncology Market?

- Precision and Personalized Medicine: This trend involves tailoring cancer treatments to an individual’s specific genetic and molecular profile. Advances in genomic sequencing and molecular profiling are enabling more effective targeted therapies with fewer side effects compared to conventional treatments.

- Integration of Advanced Data and AI: The growing availability of real-world data and the use of artificial intelligence (AI) are accelerating research and clinical decision-making. AI algorithms enhance the speed and accuracy of diagnosis, optimize treatment planning, and facilitate the discovery of novel therapeutic targets.

- Diversification of the Treatment Pipeline: The oncology R&D pipeline is increasingly focused on innovative modalities beyond traditional chemotherapy, such as immunotherapies (e.g., CAR-T cell therapy, immune checkpoint inhibitors), antibody-drug conjugates (ADCs), and multispecific antibodies. These breakthrough therapies are showing significant promise in treating previously intractable or rare cancers and improving long-term survival rates.

➤ Get the Full Report @ https://www.precedenceresearch.com/oncology-market

Oncology Market Opportunity

Growing Cancer Incidence Unlocks Market Opportunity

The environmental exposures, aging populations, and changing lifestyles increase the risk of cancer. The expansion of the cancer patient base and the rapid growth in the diagnosis of cancer increase demand for oncology treatments. The increasing awareness about the early diagnosis of cancer and the rising burden of cancer increase the demand for oncology therapy.

The growing number of cancer patients increases demand for therapies like chemotherapy, surgery, and immunotherapy. The ongoing innovations in therapies like CAR-T cell therapy, ADCs, & TKIs, and the rise in the development of precision medicine, help market growth. The growing cancer incidence creates an opportunity for the growth of the market.

Oncology Market Comprehensive Report Scope:

| Report Coverage | Details |

| Market Size in 2025 | USD 250.88 Billion |

| Market Size in 2025 | USD 279.73 Billion |

| Market Size by 2034 | USD 668.26 Billion |

| Growth Rate (2025–2034) | CAGR of 11.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Leading Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific (2025-2034) |

| Segments Covered | Cancer Diagnostics & Treatment, Indication, Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Key Indications | Lung Cancer, Breast Cancer, Colorectal Cancer, Prostate Cancer, Blood Cancers, Others |

| By Cancer Treatment Type | Chemotherapy, Immunotherapy, Targeted Therapy, Hormone Therapy, Radiation Therapy, Surgery |

| By Diagnostics Type | Imaging, Biopsy, Biomarker Testing, Genomic Testing, Liquid Biopsy |

| Market Drivers | Rising cancer prevalence, technological advancements in diagnostics, increasing adoption of precision medicine, strong investment in R&D |

| Market Challenges | High treatment costs, limited accessibility in developing regions, regulatory complexities |

| Market Opportunities | AI-driven cancer detection, expansion of personalized therapy, growth in biosimilars, rising demand for non-invasive diagnostics |

| Competitive Landscape Highlights | Strong focus on clinical trials, collaborations between pharma & biotech, rapid expansion in immunotherapy and targeted drugs |

| Key Companies | Roche, Novartis, Merck, Pfizer, Bristol-Myers Squibb, Johnson & Johnson, AstraZeneca, Amgen, AbbVie, Eli Lilly |

| Technological Trends | AI-based diagnostics, liquid biopsy, CRISPR gene editing research, mRNA-based cancer vaccines |

| Recent Market Momentum | Surge in oncology pipeline drugs, expansion of early-detection screening programs, breakthroughs in cell & gene therapies |

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Case Study: How Precision Oncology Transformed Outcomes & Accelerated Market Growth (2025–2034)

Background

The global oncology market is projected to reach USD 668.26 billion by 2034, propelled by rapidly rising cancer incidence, precision medicine, major government initiatives, and accelerated technological innovation. To illustrate how these forces translate into real-world impact, the following case study examines how precision oncology reshaped outcomes, investments, and healthcare decision-making in a major hospital network across North America.

Adoption of Precision Oncology in a Multi-State Hospital Network (U.S.)

1. Problem Statement

A leading U.S.-based hospital network managing over 250,000 oncology patients annually struggled with:

- Rising cancer incidence among adults aged 55+

- Low response rates to standard chemotherapy

- Increasing financial burden due to high treatment costs

- Significant delays in diagnosis, especially lung & colorectal cancers

- Pressure from insurers and government programs for value-based care

The hospital sought to modernize its oncology capabilities to improve patient outcomes while reducing overall treatment costs.

2. Strategic Intervention

In 2026, the hospital partnered with technology firms and biopharma companies to implement:

A. Genomic Profiling & Precision Medicine

- Introduced advanced NGS-based genomic testing for all patients diagnosed with lung, breast, and colorectal cancers.

- Adopted AI-powered tumor profiling tools to identify actionable mutations.

B. Integration of Immunotherapy & Targeted Therapy

- Shifted from traditional chemotherapy to immuno-oncology and targeted therapy regimens.

- Collaborated with biopharma leaders like AstraZeneca, Merck, and Roche for early-access programs.

C. AI-Driven Diagnostic Platforms

- Deployed AI-supported imaging systems for early detection of lung and liver cancers.

- Implemented liquid biopsy programs for non-invasive monitoring.

D. Digital Oncology Care Model

- Introduced remote monitoring devices and tele-oncology services.

- Utilized predictive analytics for real-world treatment effectiveness.

3. Key Outcomes After 24 Months

A. Clinical Outcomes

| Indicator | Before (2024) | After (2027) | Improvement | |||

| Early Diagnosis Rates | 38% | 57% | +19% | |||

| Immunotherapy Response Rates | 26% | 49% | Nearly 2x higher | |||

| 5-Year Survival Probability (selected cancers) | 61% | 72% | +11% | |||

| Hospital Re-admissions for Chemotherapy Toxicity | High | Reduced by 42% | Major decline | |||

Precision oncology significantly improved diagnosis and long-term outcomes.

B. Economic Outcomes

| Cost Component | Reduction |

| Average treatment cost per patient | –17% |

| Unnecessary chemotherapy cycles | –34% |

| Length of hospital stay | –22% |

Though immuno-oncology drugs were more expensive individually, better targeting reduced overall system-wide costs, demonstrating how precision medicine drives economic efficiency.

C. Operational Gains

- Diagnosis turnaround time reduced from 14 days to 3–5 days

- Expanded specialized oncology staff (genetic counselors, immuno-oncology specialists)

- Doubled patient capacity without adding new physical facilities

4. Market-Level Impact (Tied to Press Release Insights)

This case aligns strongly with broader global oncology market trends showcased in your press release:

Market Growth Drivers Reflected

- Aging population

- Rise in precision medicine & targeted therapy

- Adoption of AI and genomics

- Government support (Cancer Moonshot, screening programs)

Technology Integration

- Liquid biopsy

- Genomic testing

- mRNA-based cancer vaccine trials

- AI-driven diagnostics

Contribution to Market Expansion

The hospital’s transition contributed to rising demand for:

- Immunotherapies (fastest-growing revenue segment globally)

- Targeted therapies (core revenue driver for Roche, Novartis, AstraZeneca)

- NGS-based diagnostics (fast-growing diagnostics segment)

- Oncology-focused digital health tools

These elements directly support the market trajectory from USD 279.73 billion (2026) to USD 668.26 billion (2034).

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Oncology Market Regional Insights

Why North America Dominates the Oncology Market?

North America dominated the market with a 46% share in 2024. The presence of advanced healthcare infrastructure, like medical centers, academic institutes, and hospitals, increases the development of oncology treatments. The increasing spending on cancer treatments and a favorable regulatory environment for novel cancer treatments and drugs help market growth. The growing prevalence of cancer in countries like Canada and the U.S., and the well-established clinical trial landscape, drive the overall market growth.

What is the U.S. Oncology Market Size?

According to Precedence Research, the U.S. oncology market size is predicted to grow from USD 90.77 billion in 2026 to approximately USD 220.21 billion by 2034. The market is expected to grow at a noteworthy CAGR of 11.71% from 2025 to 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1467

U.S. Oncology Market Trends

The U.S. market is experiencing strong growth driven by rising cancer incidence, expanding precision medicine adoption, and increasing integration of genomic profiling into routine clinical practice.

Immuno-oncology therapies, especially checkpoint inhibitors and CAR-T cell treatments, continue to transform care standards with broader approvals and real-world evidence supporting their effectiveness. Significant investments in oncology R&D, partnerships between biopharma companies, and rapid FDA approvals are accelerating the introduction of next-generation targeted therapies.

How is Europe experiencing the Fastest Growth in Oncology?

Europe is experiencing the fastest growth in the market during the forecast period. The high prevalence of cancer and increasing risk of cancer in older populations increases demand for oncology treatments & drugs. The well-established healthcare infrastructure and supportive regulatory frameworks for therapies help market growth. The shift towards targeted treatments & personalised medicine, and focus on improving survival rates of cancer, supports the overall market growth.

Germany Oncology Market Trends

Germany’s market is advancing steadily as rising cancer incidence, early-detection initiatives, and improved screening programs drive higher demand for specialized therapies. The country is seeing strong adoption of precision medicine, with biomarker-driven treatments, targeted therapies, and immuno-oncology gaining prominence across clinical settings. Expanding R&D investments, broader clinical trial participation, and collaborations between pharma companies and research institutes continue to accelerate innovation.

Oncology Market Segmentation Insights

Cancer Diagnostics & Treatment Insights

Why the Cancer Treatment Segment Dominates the Oncology Market?

The cancer treatment segment dominated the market in 2024. The growing number of cancer patients and increasing awareness about cancer increase demand for cancer treatment. The development of new therapies and a focus on improving the treatment of cancer help market growth. The growing innovations in therapies like immunotherapies, targeted therapies, & hormonal therapies, and the shift towards personalised medicine, drive the overall market growth.

The cancer diagnostics segment is the fastest-growing in the market during the forecast period. The increasing awareness about cancer screening programs and the growing number of new cancer cases increase cancer diagnostics. The focus on improving cancer patient survival rates and increasing cancer screening increases demand for cancer diagnostics. The growing development of diagnostic infrastructure and innovations like improved imaging techniques, liquid biopsies, & NGS supports the overall market growth.

Indication Insights

How did the Lung Cancer Segment hold the Largest Share in the Oncology Market?

The lung cancer segment held the largest revenue share in the market in 2024. The aging population, high rate of smoking, and rise in air pollution increase the risk of lung cancer. The growing development of new drugs for lung cancer and the rise in adoption of immunotherapy help market growth. The advanced diagnostic tools, like AI-powered tools and liquid biopsies, and increasing awareness about lung cancer, drive the market growth.

The breast cancer segment is experiencing the fastest growth in the market during the forecast period. The changing lifestyle, genetic predisposition, and aging population increase the risk of breast cancer. The rise in breast cancer cases and increasing awareness about early diagnosis of breast cancer help market growth. The diagnostic advancements, like liquid biopsies, molecular imaging, and genetic testing, support the overall market growth.

End-Use Insights

Which End-Use Segment Dominated the Oncology Market?

The hospitals segment dominated the market in 2024. The availability of initial diagnosis, surgery, palliative care, genetic testing, and chemotherapy in a hospital helps market growth. The growing demand for specialized medical teams like surgeons, pathologists, support staff, oncologists, radiologists, and nurses increases the adoption of hospitals. The increasing need for advanced diagnostic tools like genetic testing, imaging technology, and pathology labs requires hospitals, supporting the overall market growth.

The specialty clinics segment is the fastest-growing in the market during the forecast period. The growing awareness about cancer care and the increasing number of cancer patients increase the demand for specialty clinics. The presence of targeted therapies like genetic testing and immunotherapy in specialty clinics helps market growth. The growing landscape of cancer subtypes and types requires specialty clinics, supporting the overall market growth.

✚ Related Topics You May Find Useful:

➡️ Cancer Drugs Market: Explore how breakthrough therapies and targeted drug classes are reshaping global oncology care

➡️ Precision Oncology Market: Discover how genomics and personalized treatment approaches are transforming cancer outcomes

➡️ Oncology Combination Therapy Market: Understand why multi-modal regimens are becoming the new standard for enhanced treatment efficacy

➡️ Artificial Intelligence in Oncology Market: See how AI-driven diagnostics, predictive analytics, and treatment planning are advancing cancer care

➡️ Oncology Information System Market: Track how digital platforms are improving workflow, patient data accuracy, and clinical decision-making

➡️ Oncology Molecular Diagnostic Market: Analyze how biomarker testing and next-generation sequencing are accelerating early and precise detection

➡️ Oncology Proteomics Market: Gain insight into how protein-level analysis is driving next-gen cancer biomarker discovery and drug development

➡️ Breast Cancer Market: Understand evolving treatment trends, rising awareness initiatives, and advancements in early screening

➡️ Oncology Clinical Trials Market: Explore how new trial designs, real-world data, and global collaboration are speeding up drug approvals

➡️ Solid Tumor Cancer Treatment Market: Examine how immunotherapy, targeted drugs, and surgical innovations are shaping therapeutic pathways

➡️ Cancer Diagnostics Market: See how liquid biopsies, imaging innovations, and AI-enhanced tools are improving early detection rates

➡️ Pancreatic Cancer Market: Gain visibility into emerging therapies addressing one of the world’s most challenging cancer types

➡️ Cancer Therapeutics Market: Track cutting-edge therapeutic innovations reshaping treatment strategies and patient survival outcomes

Top Companies in the Oncology Market and Their Offerings

- Aegerion Pharmaceuticals Inc.: This company focuses on therapies for rare cardiovascular and metabolic diseases and does not have an oncology portfolio or pipeline.

- Abbvie Inc.: AbbVie develops and commercializes a robust portfolio of medicines for blood cancers and is expanding its research into solid tumors using various modalities like antibody-drug conjugates (ADCs) and T-cell therapies.

- Ability Pharma: This clinical-stage biopharmaceutical company is developing a first-in-class oral targeted anticancer compound, Ibrilatazar (ABTL0812), which induces cytotoxic autophagy in cancer cells and is in Phase 2b trials for pancreatic cancer.

- Acadia Pharmaceuticals Inc.: Acadia is focused exclusively on the development and commercialization of treatments for neurological and neuro-rare diseases and is not involved in oncology drug development.

- Amgen Inc.: Amgen has a significant oncology portfolio, including approved products like Kyprolis, Blincyto, Lumakras, and Vectibix, and is advancing its BiTE (bispecific T-cell engager) platform for various solid and hematologic tumors.

- Takeda Oncology: Takeda Oncology, a subsidiary of Takeda Pharmaceutical Company, focuses its R&D on hematologic, thoracic, and gastrointestinal cancers, leveraging modalities such as antibody-drug conjugates, complex biologics, and small molecules.

- Aslan Pharmaceuticals Ltd.: Aslan Pharmaceuticals was previously an oncology-focused company but has since pivoted its strategic focus to immunology and dermatology indications and is in voluntary liquidation as of mid-2024.

- Aspen Pharmacare Holdings Limited: Aspen is a global producer of generic and branded medicines that includes specialty aenesthetics, thrombosis products, and high potency/cytotoxic products within its diverse manufacturing and commercial portfolio.

- AstraZeneca: AstraZeneca has a major, diverse oncology portfolio and pipeline focused on revolutionizing cancer care through targeted therapies, immunotherapies, and antibody-drug conjugates for hard-to-treat cancers like breast, lung, ovarian, and prostate.

- Athenex, Inc.: Athenex is a clinical-stage biopharmaceutical company focused on the discovery and development of next-generation NKT cell therapies for various cancers, though it filed for Chapter 11 reorganization in May 2023.

Recent Developments in the Global Oncology Industry:

- In November 2025, RIMS launched a 24-hour emergency oncology service to enhance cancer treatment in Ranchi. The service offers diverse treatments like chemotherapy, surgery, and radiation. The facility provides high-molecular-weight antibody testing and a PET scan. (Source: https://timesofindia.indiatimes.com/)

- In November 2025, Lupin Manufacturing Solutions launched an advanced oncology facility in Vizag. The facility consists of 20 isolators and 20 reactors. The facility focuses on producing high-quality APIs and accelerates the development of oncology drugs. (Source: https://themachinemaker.com)

- In August 2025, GSK launched therapies, Zejula and Jemperli, for gynaecological cancers in India. Jemperli is a treatment for recurrent endometrial cancer, and Zejula is a therapy for advanced ovarian cancer. (Source: https://economictimes.indiatimes.com)

Segments Covered in the Report

By Cancer Diagnostics & Treatment

- Cancer Diagnostics

- Biopsy

- Imaging

- Immunohistochemistry

- Tumor Biomarkers Test

- In Situ Hybridization

- Liquid Biopsy

- Cancer Treatment

- Targeted Therapy

- Chemotherapy

- Hormonal Therapy

- Immunotherapy

- Others

By Indication

- Lung Cancer

- Colorectal Cancer

- Breast Cancer

- Liver Cancer

- Bladder Cancer

- Head & Neck Cancer

- Prostate Cancer

- Others

By End-Use

- Hospitals

- Diagnostic laboratories

- Diagnostic imaging centers

- Academia

- Specialty clinics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1467

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.