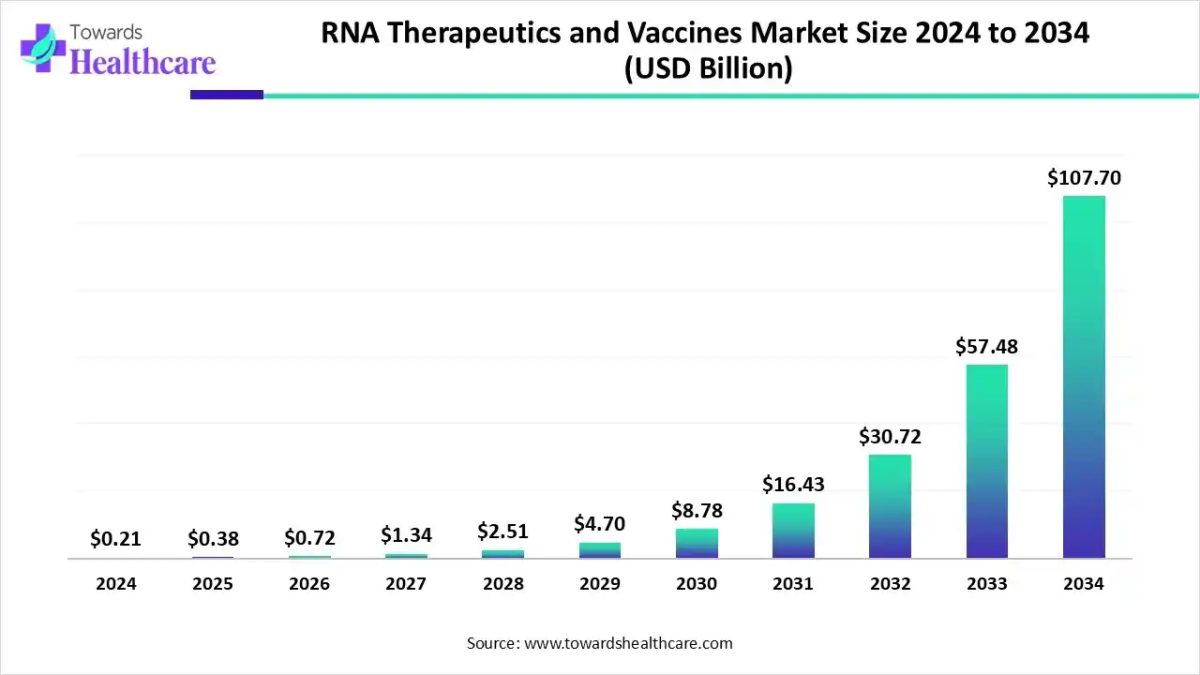

The global RNA therapeutics and vaccines market size was valued at USD 0.21 billion in 2024 and is predicted to hit around USD 107.7 billion by 2034, rising at a 87% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 02, 2025 (GLOBE NEWSWIRE) — The global RNA therapeutics and vaccines market size is calculated at USD 0.38 billion in 2025 and is expected to reach around USD 107.7 billion by 2034, growing at a CAGR of 87% for the forecasted period.

The RNA therapeutics and vaccines market is rising because rapid advances in RNA technology, especially mRNA and self-amplifying RNA platforms are enabling faster, more flexible development of vaccines and therapies for infectious, genetic, and rare diseases, driving unprecedented demand from industry, investors and global health-care systems.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6375

Key Takeaways:

- RNA therapeutics and vaccines market to crossed USD 0.21 billion by 2024.

- Market projected at USD 107.7 billion by 2034.

- CAGR of 87% expected in between 2025 to 2034.

- By region, North America was dominant in the RNA therapeutics and vaccines market, with approximately 42% share.

- By region, Asia Pacific is the fastest-growing over the forecast period, 2025 to 2034.

- By modality type, the mRNA vaccines & therapeutics segment was dominant in the market revenue in 2024, with approximately 38% share.

- By modality type, the self-amplifying RNA (saRNA) & replicons segment is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By therapeutic area/indication, the infectious diseases & vaccines segment dominated the RNA therapeutics and vaccines market revenue in 2024, with approximately 36% share.

- By therapeutic area/indication, the rare and genetic diseases segment is expected to be the fastest-growing over the forecast period, 2025 to 2034.

- By product/offering type, the finished drug products segment was dominant in the market in 2024, with approximately 40% share.

- By product/offering type, the CDMO & contract development services segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

- By delivery and enabling technology, the lipid nanoparticles (LNPs) & ionizable lipids segment was dominant in the market in 2024, with approximately 34% share.

- By delivery and enabling technology, the novel lipid chemistries segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

- By end user, the large pharmaceutical & biotechnology companies segment was dominant in the RNA therapeutics and vaccines market in 2024, with approximately 45% share.

- By end user, the CDMOs/contract manufacturers segment is expected to register the fastest growth over the forecast period, 2025 to 2034.

Market Overview:

What are the Reasons for the Demand for RNA-Based Therapies?

Many recent studies indicate an extraordinary surge in the international market for RNA-based therapies (including both mRNA and therapeutic products derived from RNA delivery systems) due to an increased need for innovative therapies to treat infectious diseases, genetic-related disorders (including cancers), and especially rare diseases.

With multiple innovations in the use of modularity, scalability, speed, and regulatory acceptability associated with RNA-based platforms (including vaccines and other applications of RNA for therapeutic purposes), there has been an even greater increase in the amount of funding available for research and development related to these platforms and, therefore, an even greater demand for RNA-based therapy products.

By 2024, the RNA-based vaccine and therapeutic industry will shift from a “niche-oriented research phase” to a generalised, widespread application. This trend is corroborated by several displayed elements of the pharmaceutical industry, Regulatory Environment, Biotech Industry, and increasing interest in RNA Technology.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

- The versatility of RNA technology can rapidly develop vaccines and therapeutics for many diseases ranging from Infectious Diseases to Cancer. Therefore, many researchers are taking advantage of RNA-based platforms to create treatment options for druggable targets that were previously treated with standard therapies.

- Recent advances in delivery systems (specifically related to Lipid Nanoparticle formulations and Lipid Chemistry) and advances in Modular Manufacturing Processes have allowed for significant molecular reduction costs, faster production time and greater stability of all RNA-based therapeutic products. Therefore, it establishes a more accessible pathway to mass manufacture RNA-based therapies.

- Increasing Public & Private Sector Investment options to develop RNA Product options, as well as the growing trend to Outsource to CDMOs, have enabled the market for RNA-based products to accelerate with greater speed. In addition, with CDMOs capabilities moving products from laboratory to market, the Pharmaceutical Industry is becoming accustomed to developing all types of RNA Products under the same highly efficient model.

- RNA-based therapies are particularly aligned with the general paradigm of Personalized or Precision Medications including Custom Therapies for specific Genetic or Rare Disorders, therefore representing the highest demand Investment Opportunities in the Biotech Industry as well as Healthcare Providers.

Key Drifts:

Extending beyond infectious diseases into oncology and rare diseases as an extension of the infectious disease vaccine market towards more advanced therapies. The shift towards Cell-Derived Manufacturing Outsourcing (CDMO) for manufacture of RNA products has occurred as companies seek to outsource many functions (RNA synthesis, formulation, LNP encapsulation and largescale production) in order to increase speed-to-market and improve efficiencies.

Significant Challenge:

While the potential for RNA based therapeutics is great, there are still significant barriers that need to be overcome in order for RNA products to be commercialised. These include instability of RNA products, delivery to cells, a cold-chain storage requirement and a complex regulatory pathway. These factors hinder development and increase the total cost of production. In addition, the barriers will further complicate the ability to produce and distribute RNA products globally, especially in lower and middle-income countries that lack distribution infrastructure.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Regional Analysis:

North America remains the largest region for RNA therapeutics and vaccines market due to its successful R&D infrastructure, strong investments from both the public and private sectors, and a well-established biopharmaceutical industry. North America also has a strong regulatory framework in place and has been an early adopter of RNA products, thereby instilling confidence in RNA technologies among all stakeholders in the healthcare industry. With a concentration of major biopharmaceutical companies and CDMO’s in North America, the region is best positioned to support the clinical development, manufacture and commercialisation of RNA therapeutics and vaccines. Therefore, the combination of resources available in North America creates a larger market presence and greater capacity for innovation within the RNA market than any other region.

The Asia Pacific region is emerging as the fastest growing region for RNA therapeutics and vaccines market. There are currently several factors driving the demand for RNA therapeus, including supportive regulatory changes, increased investment into healthcare, increased biotechnology innovation and increased demand for advanced therapeutics within densely populated nations. The Asia Pacific region is rapidly increasing its manufacturing and regulatory capabilities, thus providing the ability to be early adopters of RNA vaccines and therapies. As the ability to manufacture protein therapeutics more cost effectively and as distribution systems develop, the demand for RNA products is predicted to grow exponentially up until 2030 and beyond.

Segmental Insights:

By Type of Modality:

For the mRNA vaccines and therapeutics segment, it has the biggest share of the market in 2024 at 38%. The reason for the 38% share is due to the strong clinical validation of the non-replicating mRNA technologies, which are scalable, safe, and adaptable to accelerate vaccine development. Pharmaceutical companies are increasingly utilising traditional mRNA technologies for vaccines against infectious diseases, oncology candidates and new potential personalised therapies. In addition, continuing improvements in mRNA stabilisation and cold-chain optimisation as well as LNP delivery systems have aided in the commercial adoption of mRNA by regulatory authorities.

Self-amplifying RNA (saRNA) and Replicons will record the fastest growth (2025–2034). The projected growth is attributed to the ability of these platforms to produce a much larger amount of protein at a drastically reduced dose than that of conventional mRNA platforms. This next generation of RNA has the potential for a more robust immune response, reduced costs associated with the production of each dose and to allow for large-scale vaccination efforts in resource-limited countries.

By Therapeutic Area / Indication

Infectious disease and vaccine is projected to be the leading segment for market revenue generation in 2024, accounting for about 36% of total market revenue, due to the ongoing global demand for vaccines, expansion of immunisation initiatives and increased preparedness for the emergence of numerous viral threats. The use of mRNA platforms is also being utilised for vaccines for various viral respiratory diseases, such as seasonal flu, RSV and COVID-19 variants, as well as progressing RNA-based vaccine initiatives against HIV, Zika and malaria. The commercialisation of these vaccines has been increased due to the provision of government support through funding and creation of public/private partnerships and the use of accelerated regulatory pathways to bring mRNA vaccines to market.

This is expected to be the fastest growing segment of the market from 2025 to 2034, therefore is projected to be driven by an increasing interest in precision medicine and by more RNA-based therapy approvals granted by the FDA and EMA to treat genetic disorders that were previously untreatable. RNA-based therapeutics represent a new and innovative approach to addressing the unmet needs of patients with monogenic disorders, metabolic syndrome, neuromuscular diseases and ultra-rare inherited conditions through the ability to correct gene expression, silence mutated genes and introduce normal cytochromes into cells.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Product/Offering type:

The finished drug products led the market with the largest share in 2024. Finished Drug Products will continue to be the most widely used product types within the market and will have broad-based demand as the market begins to develop several different types of “ready-to-use” RNA vaccines, therapies, and combined products, as well as allow for larger-scale production of finished drug products via the use of pre-filled syringes and vials for the RNA injection market.

The highest market growth rate between 2025 and 2034 is projected to occur for the Contract Development and Manufacturing Organization (CDMO) and Contract Development Services Market. As the amount of data and documentation related to RNA development, synthesis, formulation, analytics, and production continues to increase, CDMO’s are likely to provide the greatest amount of growth for this segment because they have become the preferred method used by most biotechnology companies when developing RNA-based therapeutic candidates. CDMO’s allow biopharmaceutical companies to avoid spending capital-intensive upfront investments into building and operating dedicated RNA production facilities.

By delivery and enabling technologies:

The leading segment in the market is projected to be the LNP & Ionizable lipid segments, with a predicted market share of 34% in 2024. Most of the growth within RNA Therapeutics Delivery will continue to be supported by the proven safety and stability, along with the relative delivery efficiencies of LNPs and Ionizable Lipids as effective delivery vehicles for delivering both mRNA-based and RNA products. As a result of LNP’s proven effectiveness as delivery systems for mRNA-based Therapeutics, LNP-based products remain the standard for delivering mRNA-based therapeutic candidates, as LNP’s protect the RNA from the environment and have a high ability to specifically target and release the RNA to the target cells.

Novel lipid chemistry, or new lipid chemistries are projected to have the fastest growth of any segment in the RNA Therapeutics Technology segment, as RNA Developers are focused on developing the next generation of RNA Delivery Technologies. Several categories of innovation exist within this segment; Biodegradable Lipids, New Ionizable Lipid Alternatives, Targeted Lipids, and Customizable Nanoparticle Architectures for Organ-Specific versus Systemic Delivery. The ultimate goal of developing Novel Lipid Chemistries is to address the three major limitations of current RNA Therapeutic Candidates; Toxicity, Tolerance of Repeated Doses, and Delivery Accuracy.

By End Users:

Large pharmaceutical and biopharmaceutical companies represented the largest share 45% of the industry during 2024; their strong financial ability, comprehensive research and development pipelines, and advanced understanding of regulatory processes allow them to create and market RNA therapies quickly. The size of these firms also permits the establishment of a wide network of supply chain partners and, in some cases, to manage “end-to-end” capabilities of the business model (from the time they produce their product until it is available for sale).

Between 2025 and 2034, the segment referred to as contract manufacturing organizations (CMOs) and contract development manufacturing organizations (CDMOs) are expected to grow rapidly as biopharmaceutical companies continue to transfer production of their RNA-based products to CDMO and CMO partners. The services offered by CDMO/CMOs include: (i) advanced capabilities such as high-throughput RNA synthesis, sterile fill-finish services and the ability to produce scalable liposomal nanoparticle formulations, together with (ii) a commitment to producing products under GMP conditions.

Browse More Insights of Towards Healthcare:

The global RNA analysis market size is calculated at US$ 6.86 billion in 2025, grew to US$ 7.78 billion in 2026, and is projected to reach around US$ 23.9 billion by 2035. The market is expanding at a CAGR of 13.36% between 2025 and 2034.

The RNAi therapeutics market is forecast to grow at a CAGR of 14.9%, from USD 1.47 billion in 2025 to USD 5.11 billion by 2034, over the forecast period from 2025 to 2034.

The global NGS-based RNA-sequencing market size is calculated at USD 3.74 billion in 2024, grow to USD 4.49 billion in 2025, and is projected to reach around USD 23.52 billion by 2034. The market is expanding at a CAGR of 20.1% between 2025 and 2034.

The global liquid biopsy tube market size stood at US$ 1.34 billion in 2024, grew to US$ 1.54 billion in 2025, and is forecast to reach US$ 5.32 billion by 2034, expanding at a CAGR of 14.85% from 2025 to 2034.

The consumption-type vaccine market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

The injection flu shot market size stood at US$ 10.63 billion in 2024, grew to US$ 11.8 billion in 2025, and is forecast to reach US$ 29.97 billion by 2034, expanding at a CAGR of 10.93% from 2025 to 2034.

The global miRNA sequencing and assay market size is calculated at US$ 391.73 in 2024, grew to US$ 443.95 million in 2025, and is projected to reach around US$ 1369.11 million by 2034. The market is expanding at a CAGR of 13.33% between 2024 and 2034.

The global mRNA quality monitoring market size is calculated at US$ 1.37 billion in 2025, grew to US$ 1.46 billion in 2026, and is projected to reach around US$ 2.5 billion by 2034. The market is expanding at a CAGR of 6.97% between 2024 and 2034.

The global microRNA market was estimated at US$ 2.31 billion in 2026 and is projected to grow to US$ 6.89 billion by 2035, rising at a compound annual growth rate (CAGR) of 12.89% from 2026 to 2035.

The global gRNA market was estimated at US$ 499.21 million in 2023 and is projected to grow to US$ 3,296.45 million by 2034, rising at a compound annual growth rate (CAGR) of 18.72% from 2024 to 2034.

Recent Developments:

On November 19, 2025, Moderna announced a US$ 140 million investment to complete its full end-to-end mRNA manufacturing capabilities in the United States, enabling on-site fill-finish drug product production and reducing dependency on external contract manufacturers.

RNA Therapeutics and Vaccines Market Key Players List:

- Moderna, Inc.

- BioNTech SE

- Pfizer Inc.

- Sanofi (including Translate Bio)

- CureVac N.V.

- Alnylam Pharmaceuticals, Inc.

- Ionis Pharmaceuticals, Inc.

- Sarepta Therapeutics, Inc.

- Arrowhead Pharmaceuticals, Inc.

- Beam Therapeutics Inc.

- Intellia Therapeutics, Inc.

- Editas Medicine, Inc.

- Lonza Group Ltd.

- Catalent, Inc.

- Acuitas Therapeutics, Inc.

- Precision NanoSystems, Inc.

- Thermo Fisher Scientific, Inc.

- Merck KGaA (MilliporeSigma)

- Arcturus Therapeutics Holdings Inc.

- Gritstone Bio, Inc.

Segments Covered in the Report

By Modality / Product Type

- mRNA Vaccines & Therapeutics

- Small Interfering RNA (siRNA) Therapeutics

- Antisense Oligonucleotides (ASOs)

- Self-Amplifying RNA (saRNA) & Replicons

- RNA Aptamers & Other RNA Modalities

- RNA-Delivered Gene-Editing Components

- Delivery Systems & LNP Components

By Therapeutic Area / Indication

- Infectious Diseases & Vaccines

- Oncology

- Rare & Genetic Diseases

- Cardiometabolic & Liver Diseases

- Neurological Disorders

- Other

By Product / Offering Type

- Finished Drug Products

- Drug Substance & Formulation

- Oligonucleotide API / GMP Synthesis

- CDMO & Contract Development Services

- Research Reagents & Preclinical Kits

- Analytical & QC Testing Services

By Delivery & Enabling Technology

- Lipid Nanoparticles (LNPs) & Ionizable Lipids

- Non-LNP Carriers

- Conjugates

- Novel Lipid Chemistries

- Formulation & Lyophilization Technologies

- Delivery Devices

- Analytical & Characterization Platforms

By End User

- Large Pharmaceutical & Biotechnology Companies

- CDMOs / Contract Manufacturers

- Academic & Research Institutions

- Government & Public Health Agencies

- Specialty Clinics / Hospitals

- Diagnostics & Companion Test Developers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6375

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.