In 2025E, the U.S. oil and gas refining market was valued at USD 468.44 billion, and by 2033, it is projected to grow to USD 600.80 billion. A report claims that improvements in refinery throughput capacity across major U.S. plants have increased by more than 20% as a result of modernization measures and the rise in refined gasoline demand.

Austin, Dec. 01, 2025 (GLOBE NEWSWIRE) — Oil and Gas Refining Industry Market Size & Growth Insights:

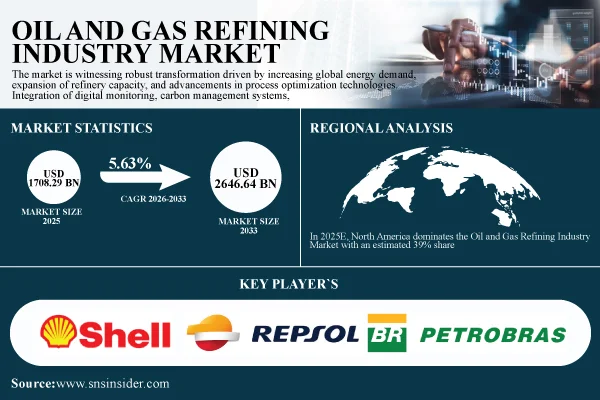

According to the SNS Insider,“The Oil and Gas Refining Industry Market size was valued at USD 1708.29 Billion in 2025E and is expected to reach USD 2646.64 Billion by 2033, registering a CAGR of 5.63% during 2026–2033.”

Increasing Integration of Cleaner Fuel Technologies to Boost Market Growth Globally

Global refiners are embracing cleaner processing technology as a result of tightening environmental laws and the need for cleaner, low-sulfur fuels. The rapid development and deployment of sophisticated catalysts, CCR (Continuous Catalytic Reforming) units, and desulfurization systems is impacted by the strict emissions regulations in major economies. By using such technologies, greenhouse gas emissions can be reduced without sacrificing product production or quality. In order to improve compliance and lessen their environmental impact, refiners are making significant investments in process energy optimization, which will drive market growth in both automotive and industrial fuel applications.

Get a Sample Report of Oil and Gas Refining Industry Market Forecast @ https://www.snsinsider.com/sample-request/8916

Leading Market Players with their Product Listed in this Report are:

- China National Petroleum Corporation

- Indian Oil Corporation Limited

- ExxonMobil Corporation

- Chevron Corporation

- Hindustan Petroleum Corporation Limited

- PJSC Lukoil Oil Company

- Petróleos de Venezuela, S.A.

- Reliance Industries Limited

- Marathon Petroleum Corporation

- BP PLC

- Bharat Petroleum Corporation Limited

- Royal Dutch Shell PLC

- Saudi Aramco

- TotalEnergies SE

- Phillips 66

- Valero Energy Corporation

- Eni S.p.A.

- Repsol S.A.

- Sinopec (China Petroleum & Chemical Corporation)

- Petrobras

Oil and Gas Refining Industry Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 1708.29 Billion |

| Market Size by 2033 | USD 2646.64 Billion |

| CAGR | CAGR of 5.63% From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Complexity (Topping, Hydro-Skimming, Conversion, Deep Conversion) • By Application (Transportation, Aviation, Marine Bunker, Petrochemical, Residential & Commercial, Agriculture, Electricity, Rail & Domestic Waterways, Others) • By Product (Light Distillates, Middle Distillates, Fuel Oil, Others) • By Fuel Type (Gasoline, Gasoil, Kerosene, LPG, Others) |

Purchase Single User PDF of Oil and Gas Refining Industry Market Report (20% Discount) @ https://www.snsinsider.com/checkout/8916

Key Industry Segmentation

By Complexity

The Deep Conversion segment holds 45% of revenue share in 2025E, driven by rising crude quality challenges and the need for maximum residue upgrading. The Conversion segment, expanding at the fastest CAGR of 9.78% during 2026–2033, benefits from increasing investments in upgrading semi-complex facilities to integrated conversion units.

By Application

The Transportation segment dominates with 36% revenue share in 2025E, driven by rapid vehicular fuel consumption and growing urban mobility trends. The Aviation segment records the highest growth at a 10.99% CAGR, boosted by rising global air traffic and sustainable aviation fuel (SAF) initiatives.

By Product

Middle Distillates capture 53% revenue share in 2025E, driven by growing demand for diesel, kerosene, and jet fuel across transport and industry. Light Distillates witness the fastest growth, supported by expanding petrochemical demand and gasoline blending flexibility.

By Fuel Type

Gasoline holds 43% revenue share in 2025E, driven by high automotive demand and economic recovery across major economies. Kerosene is projected to register the fastest growth rate due to the surging aviation recovery and clean jet fuel blending advancements.

Regional Insights:

With an expected 39% of the oil and gas refining industry market in 2025E, North America leads due to refinery modernization initiatives and the use of cutting-edge technology. Strong regulatory support for digital refinery operations, upgrading unit growth, and sustainable energy integration helps the region.

Asia Pacific is the fastest-growing oil and gas refining region, with an estimated CAGR of 8.60%, driven by rising energy demand, rapid industrialization, and large-scale refinery expansions.

Do you have any specific queries or need any customized research on Oil and Gas Refining Industry Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/8916

Recent News:

- In February 2025, CNPC launched a low-carbon refining initiative integrating bio-feedstock blending and CO₂ recycling systems across its Dalian refinery to enhance emissions performance.

- In May 2025, IOCL commissioned its hydrogen production unit at Panipat Refinery, supporting green fuel hydrogen integration and low-carbon refining strategies.

Exclusive Sections of the Oil and Gas Refining Industry Market Report (The USPs):

- REFINERY CAPACITY & UTILIZATION METRICS – helps you understand operational efficiency by analyzing total refining capacity, annual utilization rates, and output yields for gasoline, diesel, jet fuel, and petrochemicals across refinery types.

- FEEDSTOCK DEPENDENCY & SUPPLY CHAIN INDEX – helps you identify crude sourcing risks and cost patterns through insights on crude-type share (light/medium/heavy), procurement cost variations, and disruption levels tied to geopolitical or logistical factors.

- ENVIRONMENTAL COMPLIANCE & SUSTAINABILITY PERFORMANCE – helps you evaluate the industry’s alignment with global standards using metrics such as emission reduction gains, compliance percentages, and water/energy consumption per barrel.

- INVESTMENT & OPERATIONAL EFFICIENCY SCORE – helps you compare refinery competitiveness by assessing capex for upgrades, operating costs per barrel, ROI, and the payback period of advanced refining technologies.

- TECHNOLOGY-DRIVEN PROCESS OPTIMIZATION INSIGHTS – helps you uncover opportunities for modernization by correlating emerging refinery technologies with improvements in output yield, energy efficiency, and environmental performance.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. Business Upturn takes no editorial responsibility for the same.